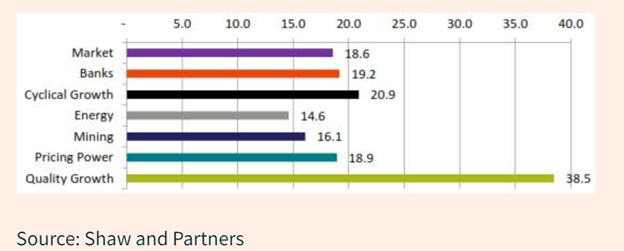

Any way that you cut it, the Australian market is looking expensive. The ASX 100 is trading on a forward price-to earnings ratio (PER) of 18.6x, well above its 10 year average of 15.5x. This is while earnings growth looks muted over the next 12 months.

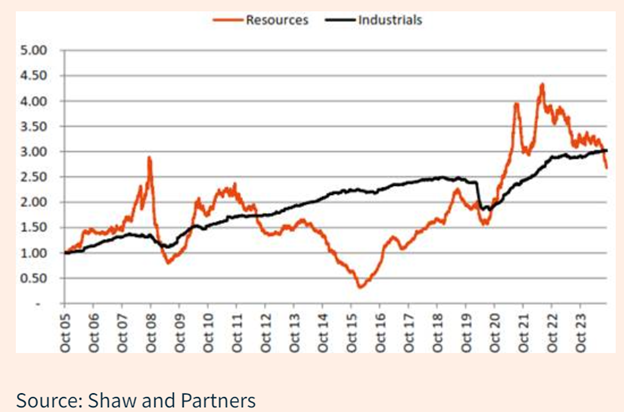

Earnings from resources have dipped sharply in recent years, while those of industrials have held relatively steady. The hope for resources is that stimulus from China can kickstart a renewed earnings upcycle—though that remains just a hope for now.

There doesn’t appear to be many places to hide, either. Valuations appear steep across most sectors.

While the mining and energy sectors are cheaper than the market, they deserve to be given their sensitivity to commodity prices. Banks appear very expensive, while ‘growth’ stocks are priced in another stratosphere.

It’s time to play defenceThere are times when it’s best to play offence in investing, and other times when defence is called for. Right now appears to be one of those moments when defence should be the priority.

To that end, I’ve put together a list of 10 defensive ASX stocks to own for the long term (5-10 years). Let’s go through the criteria I used to create the list:

Part of the ASX 300. Ideally, you want to own well-established firms that have some history of durability and success. The smallest company in the ASX 300 has a market capitalization of under $600 million. This criterion then excludes most small caps and includes mid and large caps.A sustainable competitive edge. Competitive advantages help companies defy the laws of capitalism, which suggest that businesses which have high returns of capital will have those returns competed away. Competitive edges can come from many things including network effects, intangible assets, cost advantages, switching costs, or efficient scale. They provide defensive qualities to companies.Resilient earnings. I don’t want to own companies where earnings can fall 50% in an economic downturn. I want businesses where earnings are going to hold up, barring extraordinary events. Owning companies with competitive edges will help with this, as will owning ones that operate in less cyclical industries.A runway of growth opportunities. I don’t just want companies that have resilient earnings but ones that can also grow profits. To do this, they need to have visible, multi-year growth opportunities.Good returns on capital. If I had to name one metric to identify a quality company, it would be return on capital. Put simply, it’s the profits that a stock makes from the equity and debt that’s put into the business.Sound balance sheets. Ideally, you want to own companies that don’t rely on too much debt to generate returns. Excessive debt makes companies fragile and less defensive.Reasonable or cheap valuations. They aren’t easy to find on the ASX, but I prefer to own companies that have a ‘margin of safety’ to them. There are several ASX growth stocks priced to perfection at >100x P/E, and it won’t take much to go wrong for their prices to tumble—as WiseTech shareholders have found out. I want quality, but not at any price.It’s an extensive list of criteria, though necessary given the purpose is to find the best defensive businesses for the long term.

Some of the exclusions from my list may be controversial, so let’s first go through these:

The 4 major banks. I haven’t included any of the banks in the list. There are several reasons for this. First, they operate in a cyclical industry where profits are highly sensitive to any economic downturn. Second, there are limited growth opportunities for them. Earnings have been flat to down over the past decade, and the future is unlikely to be much different. Third, they rely on the housing market, which has had a stupendous 40-year bull market that’s unlikely to be repeated during the next decade. For these reasons, my view is the banks will struggle to beat indices over the long term.The major miners. BHP and Rio Tinto don’t make the list. Size is a major factor as it requires massive investments and returns just to move the needle for these behemoths. Also, mining is highly cyclical and capital intensive, which limits returns on capital. Finally, the tailwind from Chinese infrastructure and property is over and that will make it harder going for iron ore in future.Woolworths and Coles. Yes, these grocery retailers operate in an oligopoly, but they’re in a mature market with limited growth prospects. They also aren’t cheap, despite recent run-ins with regulators.The 10 stocksHere is the list:

ASX Ltd (ASX: ASX)Stock exchanges are incredible businesses. They are essentially like gatekeepers to trading securities. That makes them asset light, high return, and durable businesses. There are avenues for growth via data and technology too.

ASX Ltd has had its issues in recent years, all self-inflicted. With a replacement for its clearing system shelved after many years of delays and cost overruns, ASX has endangered one of the key sources to its competitive edge: a supportive regulatory environment. However, it isn’t a mortal blow, and relations with government should be repaired in time, helping the company to retain its various monopolies in capital markets for decades to come.

Auckland International Airport (ASX: AIA)Airports are generally fantastic businesses as they’re often monopolies with pricing power. With Sydney Airport no longer listed (a shame), Auckland International Airport is the next best thing. It relies on airport traffic and more broadly, New Zealand being a destination that people want to visit.

The stock has significantly underperformed of late thanks to a recent $1.4 billion capital raise to fund a large upgrade of airport facilities. This significant investment will dampen cashflow for several years.

Much of this is now in the price and it offers the chance to buy superb assets at a reasonable valuation.

This one is subject to debate. I like rail assets. Rail has an enduring cost advantage over road transport for bulk commodities. The downside of the industry is that it requires huge investment, and that limits returns on capital. With Aurizon, it’s also over-reliant on coal. However, this reliance will reduce over time, and should hopefully be less of a concern.

The company is inexpensive and has a nice dividend to boot.

EQT Holdings (ASX: EQT)EQT is one of the two big players in trustee services. The other is Perpetual, which recently sold its corporate trust and wealth divisions to KKR. EQT has been around for 135 years and is exceptionally well connected, with a who’s who of people who’ve served on its board. It also benefits from tailwinds of growing wealth in Australia and an ageing population. It’s a keeper.

James Hardie (ASX: JHX)Since it pioneered the development of fiber-cement technology in the 1980s, it’s dominated the fiber-cement siding category for houses in the US and Australia. It has a long runway of growth and a sustainable edge based on brand and scale that should keep competitors at bay, resulting in above average returns for years to come.

After a good run over the past 12 months, the stock isn’t unreasonably valued, though isn’t cheap either. Ideally, I’d like to buy it at a lower price.

Medibank Private (ASX: MPL)With an ageing population, higher demand for healthcare will put pressure on the public health system. That makes private health insurers such as Medibank attractive propositions.

The stock has two headwinds. It operates in a heavily regulated industry where premium increases must be approved by government. There are also growing calls for fund model changes for private hospitals, which could impact insurers like Medibank. This is something to keep a close eye on.

Qube (ASX: QUB)Qube is a consolidator of the domestic port logistics industry. Competitors are typically small operators with limited geographic scope offering limited point-to-point services for the export and import of containers, bulk products, automobiles, and general cargo.

Qube has built or acquired an asset network across more than 200 locations. The business has achieved respectable mid-single digit EPS growth over the last decade, yet heavy capital investment has pressured returns on capital. Currently, Qube has a big investment into projects that haven’t fully ramped up, though should start paying off soon.

At its recent result presentation, management said that they’re on track to hit their 10% return on capital employed target and are confident enough to upgrade the target to 12%+ over the medium term.

SkyCity Entertainment Group (ASX: SKC)How can I pick a casino operator after the recent shenanigans at Star and Crown? Well, SkyCity has long dated and exclusive licences in Auckland and Adelaide. Unless they operate in the reprehensible ways of their competitors, their monopoly assets should continue to generate nice, long-term returns. It also helps that SkyCity is less reliant on VIP customers than Star and Crown, and therefore has more defensive earnings.

The stock has had a rough ride, though looks great value at the moment.

The Lottery Corporation (ASX: TLC)The company has a near-monopoly on long-dated licences across all states and territories, except Western Australia. Though it’s a mature business, it has considerable pricing power and should deliver steady and sound returns for a long time to come.

At 17x Enterprise Value to Ebitda (EV/Ebitda), the shares look decent value.

Washington H Soul Pattinson (ASX: SOL)This is a family-owned conglomerate that’s proven its chops over a long period. It has large stakes in Brickworks, TPG, and New Hope Corporation. All these companies are operating in industries which have had cyclical downturns over the past few years, which should ease and drive better earnings in coming years. Soul Patts is also expanding into exciting areas such as aged care.

The company’s edge comes from its investing prowess. The risk is that Robert Millner isn’t getting younger and those that follow may not be as canny. However, the management team he’s put in place appears capable of handling the company when he retires.

Get more insights from Morningstar in your inbox