ASX closes closes up on Sigma-Chemist Warehouse merger; Nine ...

The Australian share market bounced back after the ACCC approved the Sigma and Chemist Warehouse merger. Nine felt the wrath of investor fury, while supermarkets and the RBA were a key focus.

Look back at the day's events.

Disclaimer: this blog is not intended as investment advice.

Key Events

Energy up, real estate down on ASX 200

2 hours agoThu 7 Nov 2024 at 6:01am

How retailers are making suppliers help with display costs

2 hours agoThu 7 Nov 2024 at 5:43am

ASX closes up 0.3 per cent, Sigma finishes on top

2 hours agoThu 7 Nov 2024 at 5:29am

2h agoThu 7 Nov 2024 at 5:41am

Price current around 4.30pm AEDT

Key Event

2h agoThu 7 Nov 2024 at 6:01am

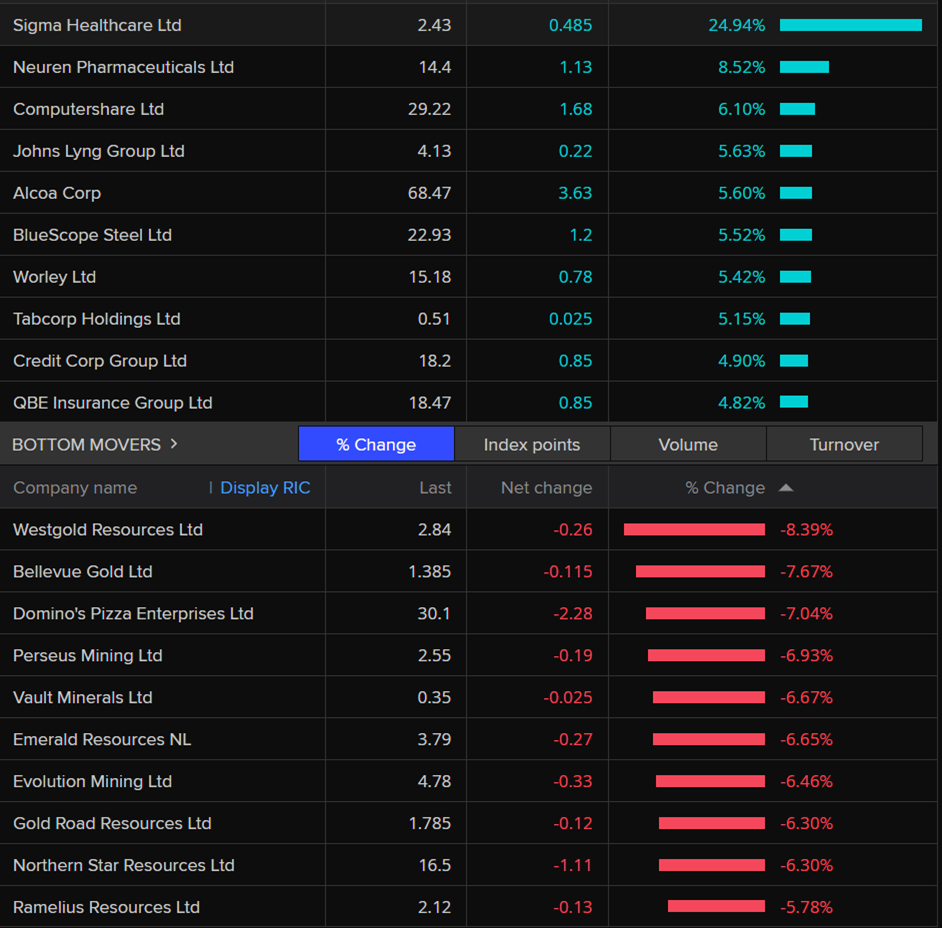

Here's how the day finished up on the ASX 200.

As you can see, Sigma lifted the index on news the ACCC had approved its merger with Chemist Warehouse:

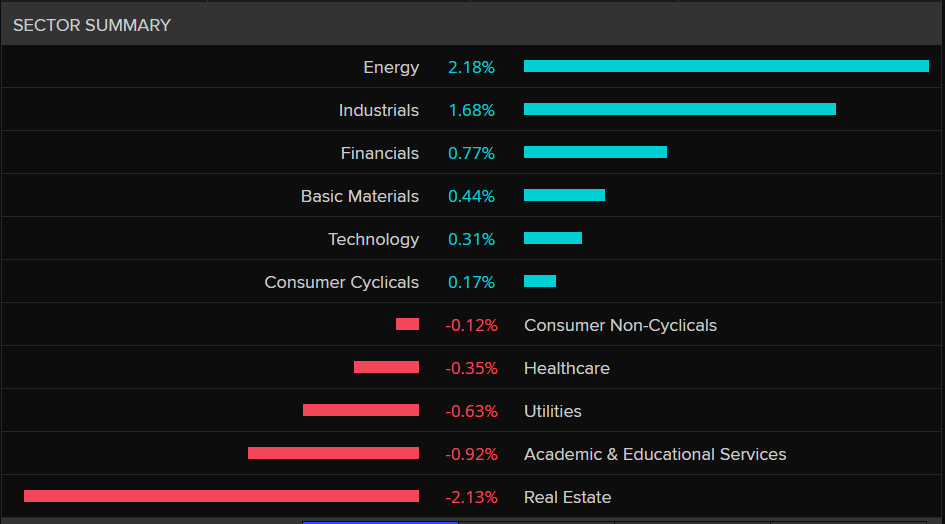

ASX 200 Thursday(LSEG/ASX)This is how the sectors finished up:

ASX 200 sectors Thursday (LSEG/ASX)A good day for energy, a bad one real estate.

A very good day for Sigma.

2h agoThu 7 Nov 2024 at 5:53am

Thanks for being with us on this busy business dayWe're going to leave our blog here.

The ACCC inquiry is still going for the day. If you're keen to watch more of AFGC speaking about pressures on suppliers when they sell to the supermarkets, you can watch this link.

I'll be back covering this inquiry again tomorrow with my colleagues.

Key Event

2h agoThu 7 Nov 2024 at 5:43am

We're reaching the end of today's ACCC inquiry into supermarkets. Right now, the supplier advocacy group AFGC is still appearing, with their reps breaking down costs on suppliers.

One interesting tidbit I've learned off them is that about a decade ago, major supermarkets started asking suppliers to not supply products in crates but in "shelf friendly" packaging.

That is packaging that can be put straight onto a shelf of a store, bringing down labour costs of unpacking for the retailer. The cost of this is borne by suppliers, AFGC says.

We're also hearing about "wastage". AFGC says suppliers often pay a general cost for this in retail stores.

AFGC says there is "strong encouragement" on suppliers to pay to be advertised in the media channels owned by major supermarkets, such as magazines run by Coles.

They say there is some benefits to suppliers to advertise in these channels but the methodology and drive to new sales is opaque.

2h agoThu 7 Nov 2024 at 5:35am

Trump trade policies may not be as bad as feared for China, Australia: economistsSome interesting notes on the effects of Donald Trump's major economic policies — notably tariffs — on Australia and our largest trading partner, China.

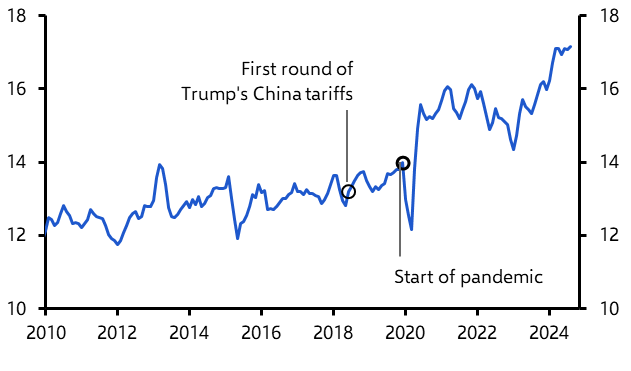

First to China, which Julian Evans-Pritchard from Capital Economics says wouldn't necessarily be as badly affected by US tariffs as many suppose.

"We estimate that the direct impact of even a 60% US tariff on goods from China would be well under 1% of China's GDP," noted Evans-Pritchard, adding that is could even generate a short-term boost as buyers brought forward imports to beat the tariffs.

Capital Economics argues the first round of tariffs had little effect on China's share of global goods exports(Capital Economics)"The bigger challenge for policymakers could be the pressure this would put on the renminbi.

"The impact of US tariffs would be magnified if they triggered a broad global retreat behind protectionist walls. But we think that other major trading economies and China itself are likely to want to preserve many of the benefits of open trade.

"Indeed, a pivot to tariffs and isolationism by the US that antagonised traditional allies might provide an opportunity for China to undermine Western controls on its access to strategically-important technology."

So, as many economists have argued, big tariff barriers could be a huge own goal for America.

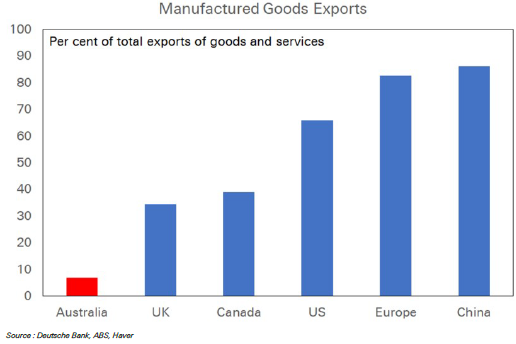

What about Australia? It's not only the Reserve Bank that is reasonably sanguine about the likely effect of Trump's tariffs here.

Deutsche Bank's Phil O'Donaghoe says Australia has a "tariff resistant export basket" due to our over-reliance on commodity sales and relative under-reliance on manufactured goods exports.

Manufacturing makes up a tony segment of Australia's exports(Deutsche Bank)"If tariffs challenge China's ability to pursue export-driven growth, authorities will likely look for growth elsewhere," O'Donaghoe continues.

"Infrastructure spending is an attractive alternative, and that would be supportive for iron ore prices."

He says that could drive iron ore prices back as high as $US130 a tonne, in a boost to mining profits, national income and the federal (and WA) budget bottom lines.

But Julian Evans-Pritchard does have one major concern about the incoming Trump administration's China policies — that is uncertainty around its attitude towards Taiwan.

He says the views of people in Trump's wing of the Republican Party range from hawks who will take a hard line to protect Taiwan against China to those willing to make big concessions around the sovereignty of the island, which China views as a breakaway province.

He warns this risks potential conflict, which would have disastrous economic and human consequences.

Key Event

2h agoThu 7 Nov 2024 at 5:29am

The Australian share market has closed for Thursday.

The ASX 200 gained 0.3 per cent, with energy, industrials and banks the strongest sectors.

Unsurprisingly, the top performing stock was Sigma, which finished trading up 25 per cent.

The boost to the company's chare price cameafter the ACCC gave its merger with Chemist Warehouse the green light.

We'll bring your more on how the ASX finished up on Thursday shortly.

Key Event

2h agoThu 7 Nov 2024 at 5:16am

Nine investors let their anger be known and loudly at the company's AGM in Sydney today.

Nine Entertainment has been dealing with the fallout of a damning review of the company's workplace practices and culture, which revealed a systemic issue with abuse of power and authority, bullying, discrimination and sexual harassment.

In Sydney today, shareholders delivered a protest vote against executive pay packets, with 37% of investors voting against Nine's renumeration report.

The Australian Shareholders Association voted in favour of the renumeration report, but said it outlined its concerns.

"Australian Shareholders’ Association highlighted to Nine our concerns with their remuneration structure including to their short-term and long-term incentives to better incentivise CEO performance," Australian Shareholders Association CEO Rachel Waterhouse said.

"Retail shareholders expect to see a culture change in NEC with a detailed plan and have confidence that there is a culture in place where poor behaviour is not tolerated and leads to consequences."

It was at times a tense meeting with re-elected chair Catherine West copping a series of questions about the report released in October.

17 per cent of shareholders voted against West's re-election.

Acting chief executive Matt Stanton has canvassed another $50 million in costs will need to cut from the business in the coming months.

Nine owns some of the nation's biggest media brands like The Sydney Morning Herald, The Age and the Australian Financial Review. It also owns Channel Nine, Stan and radio stations 2GB and 3AW.

The year of upheaval has seen the company's share price slashed from about $2 in January to $1.10 this afternoon.

If you need a reminder of how bad Nine's company culture report was, take a read this piece from ABC business reporter Nassim Khadem:

3h agoThu 7 Nov 2024 at 5:01am

Sigma is still up 23 per cent on ACCC's decisionMeanwhile, on the stock market, Sigma is today's highest performing stock with a surge of 23%.

That's off the news that the ACCC has approved its merger with Chemist Warehouse to create Australia's biggest pharmacy group.

Nassim Khadem is covering this story for you tonight on ABC's The Business plus on ABC's 7pm News bulletins.

More info here.

3h agoThu 7 Nov 2024 at 4:57am

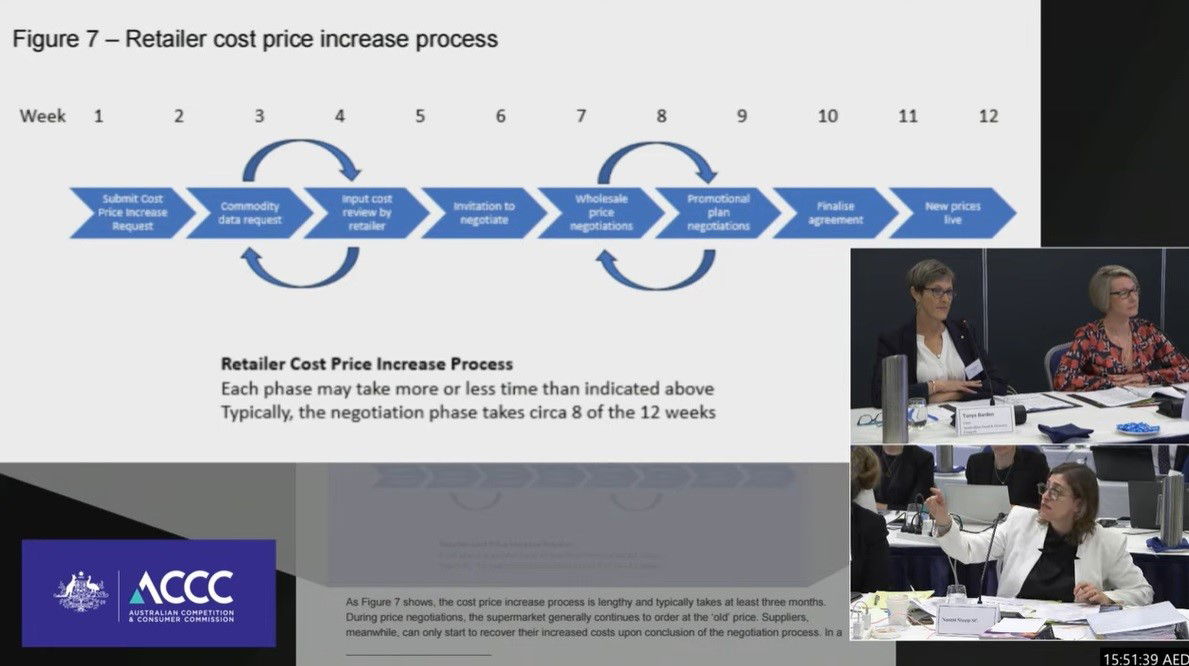

How price negotiations go between suppliers and supermarketsThe ACCC inquiry is now looking at this flow chart.

Try wrapping your head around it!

Also... if you're a supplier to a major retailer that is reading right now, please feel free to reach for a confidential chat on [email protected].

Key Event

3h agoThu 7 Nov 2024 at 4:41am

The ACCC is getting AFGC to explain the trading terms and contracts that suppliers are under when selling products to the major supermarkets.

We've heard that suppliers sign a blanket contract when they sign up to supply a product, but that doesn't include terms like price or quality.

"You don't have certainty of quantity until (an order is made)," the AFGC is teling the inquiry.

"And certainty of price is not over the long term."

Suppliers can also face costs such as freight and promotional charges, as well as "rebates" when retailers make big orders.

"They'll be payments for merchandising," they say.

AFGC says its mostly Coles and Woolworths that have the most variance in their contracts, opposed to Aldi and Metcash.

For anybody that's read up on the liquor and hardware space, these sorts of charges to suppliers is common there too.

3h agoThu 7 Nov 2024 at 4:26am

Suppliers are facing dropping profits to supermarkets, AFGC saysIts CEO Tanya Barden is speaking at the ACCC supermarket inquiry.

She says the food manufacturing sector's seen falling takings from $8b to $5b dollars in the period from before COVID-19.

"The suppliers are predominately selling most of their products through the major supermarkets," she adds.

Individual brands may have as much as 70% of their product in those two majors, Ms Barden adds.

Ms Barden says suppliers are having mostly "positive dealings" with Metcash, which has the IGA franchise.

"One of the things they do is stock local niche product," she adds.

Key Event

3h agoThu 7 Nov 2024 at 4:16am

Appearing before the Senate Economics Committee's estimates hearing today, the Australian Securities and Investment Commission (ASIC) was asked about its probe into Mineral Resources (MinRes) founder Chris Ellison.

WA Greens senator Barbara Pocock: On the 23rd of October, ASIC confirmed that it is, or will be, inquiring into Mineral Resources following the allegations that Mr Chris Ellison, the founder of MinRes, has been engaged in tax evasion for more than a decade and that real concerns exist about Mr Ellison putting his personal financial interests ahead of shareholders. Has ASIC begun its inquiry, or when will it begin?

ASIC deputy chair Sarah Court: Yes, I can confirm that we have commenced inquiries following the various media articles about this thread of issues and since I gave that evidence before to a prior committee I can confirm we've now commenced a formal investigation into these issues.

Pocock: What is the scale of the inquiry?

Court: Senator it is at a very early stage I think it's fair to say, so this information came to us like it did to many others through the media reporting recently. We have examined the allegations and had some engagement with the ATO and the investigation will follow the normal course.

More detail on those allegations are linked below:

4h agoThu 7 Nov 2024 at 4:07am

ASX is now trading slightly upLooks like investors have digested that Trump news. The ASX 200 is currently up 0.06%.

4h agoThu 7 Nov 2024 at 4:00am

Australian Food and Grocery Council next up at ACCC hearingThe two AFGC reps will speak to issues faced by suppliers to the major supermarkets, including Metcash (IGA), Aldi, Coles and Woolworths.

"We represent a broad church and our commentary today reflects that," its CEO Tanya Barden says.

4h agoThu 7 Nov 2024 at 3:52am

Yes Black and Gold is still a thing!I remember...???? I think it still exists in tiny numbers at IGA. Some corner shops had it too.

- Natty

4h agoThu 7 Nov 2024 at 3:52am

More on the RBA governor's apperance in the Senate todayMichele Bullock has rejected suggestions she cautioned the federal government about its spending behaviour, amid media reporting that she had warned the treasurer to exercise restraint in the lead up to next year's election.

"I don't believe I've been cautioning anyone," she said.

Read this full wrap by Gareth Hutchens here.

4h agoThu 7 Nov 2024 at 3:40am

What's the difference between home brand and 'phantom' brands?If you're old enough to remember Black & Gold brands in IGA supermarkets, you'll know it used to be very obvious to shopper when they are buying products known as "homebrand".

As Choice is now telling the ACCC supermarket inquiry, these days products owned or produced by the supermarkets are getting so sophisticated, that shoppers don't know they're buying private label. This is when they become "phantom".

Yet Choice is not coming out against internal products.

"Our testing often shows that homebrand comes out on top," Choice's Rosie Thomas is telling the inquiry.

"Some of the private label brands are deliberately emulating (non private label brands)," adds another rep. They add that phantom brands becomes an issue when they pretend to be a premium label, and don't even offer up a cheaper price.

Ms Thomas is urging the inquiry to look into whether private label comes with a long-term risk of crowding out non-supermarket owned products, and therefore leading to less competition and possibly higher products for customers.

4h agoThu 7 Nov 2024 at 3:35am

UpdateAgree with Jeremy on his comment regarding very low to non existent cellular coverage in supermarkets. Only improves around the registers when you either need to transfer money on your bank app or tap to pay. Unfortunately, I am not trying to be cynical.

- Chad

4h agoThu 7 Nov 2024 at 3:11am

ACCC asking Choice about the supermarket's pricing strategies and promisesWe're entering a strange stage of today's ACCC hearing where the consumer watchdog's reps are asking those giving testimony to "set aside" discussion of "Down Down" and "Prices Dropped".

The watchdog recently lodged court action against Coles and Wooloworths.

It's alleging the supermarket giants sold items at regular prices for up to six months, then increased the prices of those items by at least 15 per cent before placing them in the "Prices Dropped" Woolworths promotion or "Down Down" Coles promotion.

As the start of its public hearings into supermarkets today, deputy chair Mick Keogh noted these proceedings and that the supermarkets won't be asked about the legal action.

Choice is now being asked by the inquiry to talk about pricing strategies by the supermarkets.

They say, for instance, they haven't been able to get a "clear answer" from Aldi about whether some of their promotional slogans are actually discounts.

Choice is also raising concerns about "multi buy" tickets, with it saying some shoppers do not know that they only get a discount on an item if they buy two of them.

"It's very confusing and ambiguous for consumers," Choice's CEO Ashley de Silva just told the inquiry.

As for specials in remote Indigenous towns, where people often face far higher prices?

"In the communities, there is no specials," Choice's representative replied with a sad laugh.

Choice is arguing for standardised rules for things like instore discounts, pricing and specials.

5h agoThu 7 Nov 2024 at 3:08am

UpdateMy question relates to article ; Why Choice says it has to 'mystery shop'. Do super markets block cellular reception in store to prevent consumers to compare grocery prices?

- Jeremy

Not to our knowledge. Are you having wifi issues in a supermarket, Jeremy?

ABC/Reuters