Live updates: ASX plummets 3pc in worst two-day performance ...

Live updates on the major ASX indices:

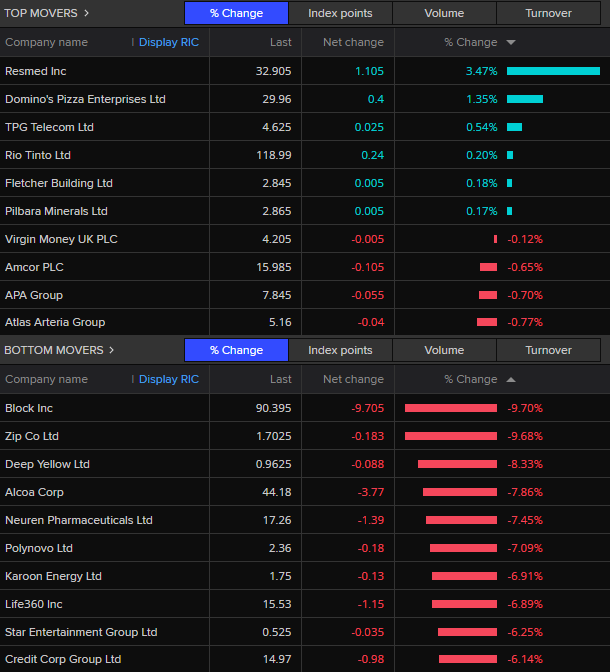

One of the very few bright spots on the ASX today is Resmed, the biotech business targeting sleeping and breathing disorders.

It's up around 4% today and the best performing stock on the ASX 200.

It has defied the general sell off with much better-than-expected margin growth across the fourth quarter, while it also upped its earnings guidance.

The news was rewarded with several broker upgrades from the likes of Macquarie, Citi, Morgans and Wilson.

Resmed has been under pressure from short sellers betting that anti-obesity drugs such as Ozempic would squeeze earnings.

Resmed share price over 5 years(LSEG, ASX)A smidge of positive news out there today with a slight pick-up in China's services economy.

The Caixin General Services PMI (Purchasing Managers' Index) accelerated from 51.2 points to 52.1 over July, the 19th consecutive month of growth.

Any reading above 50 shows an expansion in activity.

The biggest contributor came from employers hiring more staff, while there was also solid growth in new business coming in.

Caixin noted "while export business also expanded, attributed to rising interest from overseas clients and growth of tourism activity, the rate of export business expansion eased to the slowest in the current 11-month sequence".

While the services sector is growing, the manufacturing PMI shows activity in the factory sector has effectively stalled.

Key Event

ASX down 2.9% heading into afternoon sessionThe ASX 200 has fallen sharply, down 2.9% heading into the afternoon session (12:20 AEST).

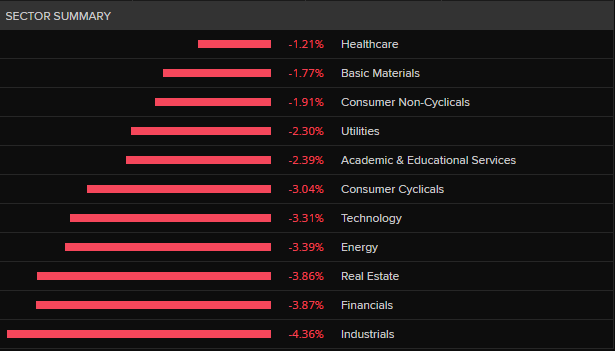

The losses are spread across the board with every sector in the red.

ASX 200 by sector(LSEG, ASX)The financials have been hit hard with ANZ (-4.0%), NAB (-4.0%) Westpac (-3.9%), CBA (-3.7%), QBE (-4.3%) and Macquarie (-5.0%) all being sold off.

The iron ore price edging up on Friday may have protected the big miners with Rio Tinto managing to gain a little ground (+0.1%) while BHP and Fortescue are down 1.6%.

Only four stocks across the top 200 have gained this morning, with Resmed being the best, up 3.5% on a strong earnings result.

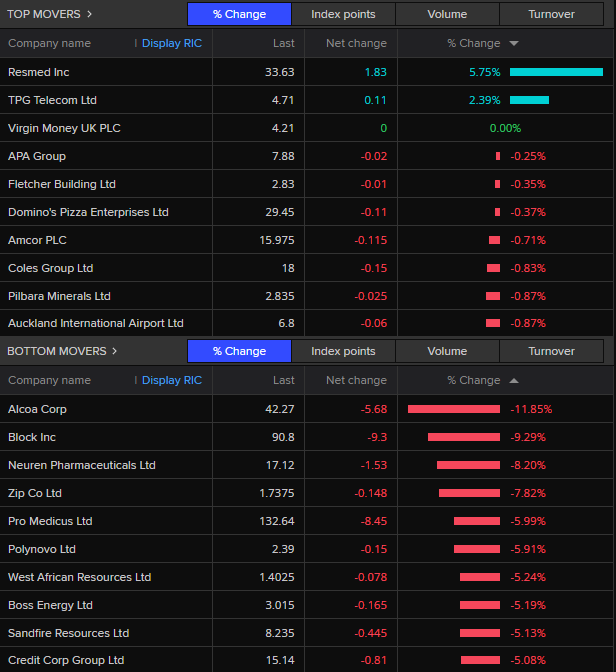

ASX 200 best and worst perfomers(LSEG, ASX)Across the region, performances are surprisingly mixed.

The Nikkei has clawed back to be down 5.4% (having opened down almost 8%), while the Hang Seng in Hing Kong is down just 0.3% and China's Shanghai Composite is up 0.4%

The Australian dollar has slipped under 65 US cents.

But the biggest loser among the asset classes today is Bitcoin, down 13.2%.

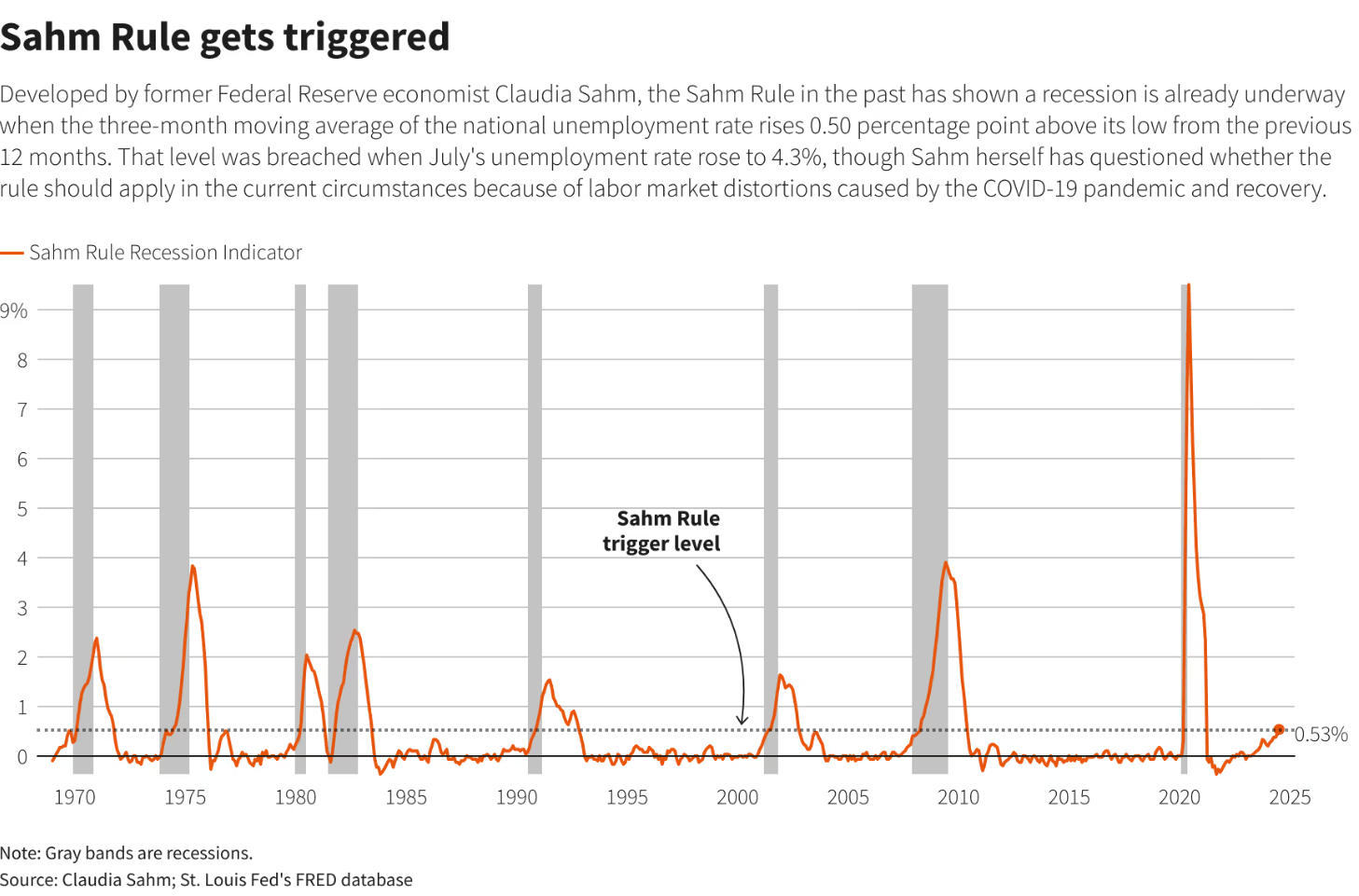

There has been a lot of excitement about the Sahm Rule bursting back into the news cycle, what with its dark portents of a recession and all, and it being held responsible for crashing stock markets across the globe.

We had a little primer earlier, but to bring a bit more intellectual rigour to the blog, we've delved back into our files and found this piece from our Canberra-based economics wiz, Gareth Hutchins.

A beaut read, maybe something to digest over lunch.

Just a quick update — the ASX has kept sliding across the morning and is down 3% — so that's a loss of almost 5% in the past two trading days.

However, that is still better than the beaten-up Japan bourse.

The Nikkei is now down almost 6% (having opened down 7.7%) and has shed more than 10 % since Friday. Ouch!

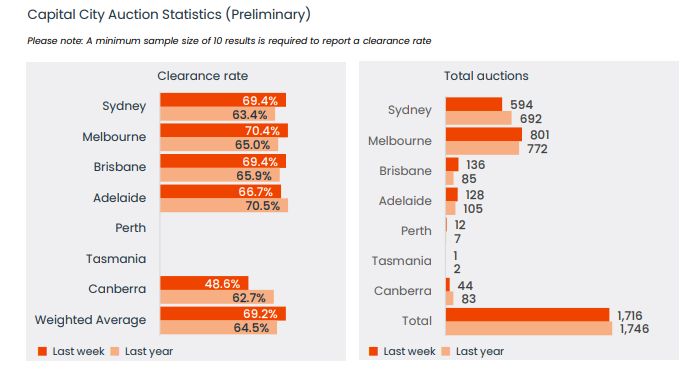

In keeping with the dominant paradigm of everything falling, even auction clearance rates fell over the weekend, down below 70% for the first time since the King's Birthday weekend back in early June.

On CoreLogic figures auction clearances came in at 69.2% across the nation, down from 72.2% the week before.

The drop in demand was oddly accompanied by a drop in supply with around 200 fewer homes going under the hammer.

Melbourne, which has lagged other capital cities recently, did a bit better with a 70.4% clearance rate on 801 homes on offer – a solid improvement on a year ago where the clearance rate was just 65%.

Canberra bidders kept their hands in their pockets (perhaps too cold to take them out?) with a clearance rate below 50%.

Capital city auction clearance rates(CoreLogic)Unless things pick up a bit from here, the ASX is heading for its worst 2-day performance since September 2022, having dropped 1.8% on Friday.

Zooming in a bit, this is what the past 5 trading days look like, with the record above 8,100 now a distant fond memory.

ASX 200 past 5 days trading(LSEG, ASX)Live updates on the major ASX indices:

Key Event

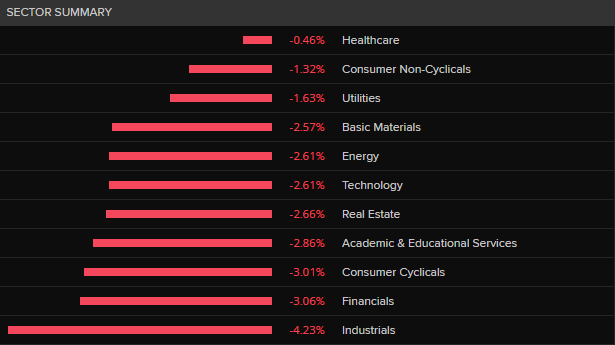

ASX 200 tumbles 2.5% on openingThe ASX 200 has fallen sharply, down 2.5% on opening, in lock step with falls seen on Wall Street and European markets on Friday's close.

The losses are spread across the board with every sector in the red.

ASX 200 by sector(LSEG, ASX)The financials have been hit hard with Wespac falling 3.9%, ANZ and NAB both down 2.7% and Macquarie slipping 3.5%.

Despite the price of iron ore edging up on Friday, the miners have been sold off this morning, both BHP and Rio Tinto are down 1.7%.

Only two stocks across the top 200 have gain this morning, with Resmed up 5.4% on a strong earnings result.

The Australian dollar has slipped under 65 US cents.

ASX 200 best and worst performers(LSEG, ASX)A big part of the markets' capitulation on Friday night was not so much the weak US jobs data, but that the rise in unemployment from 3.8% in March to 4.3% in June met the criteria for the Sahm Rule, an economic theory that is seen as a strong, but not perfect, predictor of US recessions.

So, what is the dreaded Sahm Rule?

Without pulling apart the modelling, the rule's fundamental tenet states "a recession is underway when the three-month average of the unemployment rate jumps more than half a percentage point in a year".

As NAB's Taylor Nugent notes, the three-month average is, indeed, now 0.5 percentage points above the 12-month average, thus triggering the Sahm Rule.

"That doesn't mean the US economy is in recession, just that historically a recession has usually begun when labour market spare capacity has increased this much this rapidly," Mr Nugent said.

"The read through to growth may be tempered somewhat this time because the rise in unemployment this cycle has so far been alongside strong labour force growth, rather than elevated layoffs.

"Regardless, it doesn't take a recession to justify less restrictive policy," Mr Nugent added.

As for the rule, its author, former US Federal Reserve economist Claudia Sahm, has questioned whether it is still valid in the current jobs climate, which has been distorted by the COVID-19 pandemic and the subsequent recovery.

The Sahm Rule(LSEG, Claudia Sahm, St Louis Fed's FRED database)Data wise it is a quiet week ahead offshore, but that doesn't mean markets will be tranquil.

US reporting season will likely dominate the risk-off momentum with any earnings miss likely to be punished harshly in a climate where the previously dominant sentiment of greed has switched quickly to fear.

The big industrial business, Caterpillar, often seen as a bellwether for the miner, reports as does Disney.

Last week's June quarter inflation data has taken a bit of interest of the RBA rates decision (Tuesday), although we here at the finance blog are "not ruling anything in or out" and we expect Governor Michelle Bullock to follow our lead.

The RBA's Statement on Monetary Policy may make for a more interesting read with some tinkering of forecasts likely – unemployment is likely to raised, GDP growth lowered along with headline inflation.

The Australian corporate reporting season cranks into gear this week with results from News Corp, Transurban, Mirvac and AMP on Thursday, REA Group and QBE follow on Friday.

An interesting snippet of news out of the US over the weekend came from the quarterly earnings report of Berkshire Hathaway, the conglomerate built up and run by Warren Buffett, one of the planet’s most respected investors.

Over the past quarter, Mr Buffett’s publicly listed investment vehicle has sold a net of $US75 billion in stocks and seen its cash holdings balloon out to $US277 billion, well above Berkshire Hathaway’s minimum cash position of $US30 billion, and up from $189 billion three months earlier.

One of the biggest movements was the sale of 390 million shares in tech giant Apple over the quarter, on top of the 115 million Apple shares sold in the first quarter.

Since mid-July, Berkshire Hathaway also sold more than $3.8 billion of shares in Bank of America, its second-largest stock holding behind Apple.

The company still owns around 400 million Apple shares, currently valued at $US84 billion, so it hasn’t given up on it totally, but it is an insight into Mr Buffett’s thinking – an investor who likes to buy and hold, and shows he was a bit ahead of the curve in selling down the tech giants ahead of the recent rotation out the sector.

Of course, being canny investor Mr Buffett noted back in May that while he expected Apple to remain Berkshire Hathaway's largest stock investment, selling made sense because the 21% federal tax rate on the gains would likely grow.

Good morning and welcome to another week on the ABC markets and finance blog.

Stephen Letts from ABC business team limbering up for a blow-by-blow coverage of the day's events, where every post is hopefully a winner, but none should be construed as financial advice.

Global markets embraced the Olympics on Friday – unfortunately the competition of choice was synchronised diving.

Everything went spiralling down together to close the week – twisting, turning and ultimately ending underwater.

The ASX is poised to join the belly flop brigade with pre-judging on the futures market pencilling in a score of -1.5% for the opening.

Team US – the Dow Jones ( -1.5%), the S&P (-1.8%) and the Nasdaq (-2.4%) – tumbled after worse than expected jobs data morphed expectations of a soft landing into predictions of a painful recession.

The small cap Russell 2000 that had been outperforming the big end of town weeks recently was hammered back to a three-week low, down 3.5%.

There certainly wasn't any applause from portfolio manager at Villere & Co, Lamar Villere, who didn't try to sugar coat things with the usual "that's terrific, it means rate cuts" schtick.

"Obviously the jobs number is the big headline, but we seem to have officially entered at least a rational world where bad economic news is read as bad rather than bad economic news is read as good," Mr Villere told Reuters.

"The Fed is going to cut and we're all sort of adjusted to that, that is sort of established. Now it's more like hey, did they wait too long? Do we have a recession on our hands?"

Adding to investor anxiety were big earnings misses from some tech darlings with Amazon down 8.8% and chip-maker Intel crashing 26%.

The ugly performance was repeated across Europe (-2.6%), although that was not quite as bad a Japan's final effort on Friday (-5.8%).

Oil (-3.4%) hit an eight-month low and US 10-year treasury yields dropped to their lowest level since late last year.

In keeping with the Olympic spirit, gold remained relatively in demand, dipping just 0.1%, and that was largely due to some late session profit taking.

Overall, gold gained 1.8% over the week and is just some loose change off its record high.

The big question for the day may well be which board will the ASX dive off - hopefully not the 10-metre one.

Live updates on the major ASX indices: