Live updates: Magnificent Seven lose US$800b in value as global ...

Prices current around 11:05am AEST.

Live updates on the major ASX indices:

Key Event

Why it's not looking so bad right now on the ASXAfter beginning the morning flat, Australian shares are pushing higher and we're only an hour into trade today.

So why isn't the ASX doing badly this morning?

There's a lot of people who think yesterday's sell-off on global markets might be an 'overreaction'.

"I think probably it is a bit of an overreaction, a disproportionate response to what was a weaker than expected jobs report in the US on Friday night," EY's chief Cherelle Murphy told AM.

But today, overseas investors are on the hunt for 'bargains' — and many are swooping in to 'buy the dip'.

Share markets in South Korea and Japan, in particular, have started to claw back some of yesterday's losses — rising 4.4% and 6% respectively.

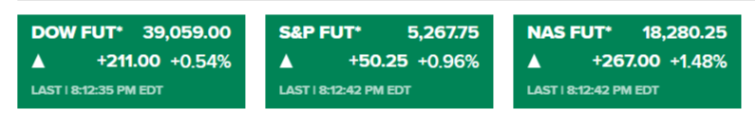

It also appears US markets are set for a rebound tomorrow, with S&P and Nasdaq futures jumping at least 1% each, according to CNBC data:

As far as the futures are concerned, US markets seem to be out of the woods for now.(Supplied: CNBC)That might explain why the ASX 200 is trading flat this morning (it could've been a lot worse).

We'll have some analysis on why the turnaround shortly.

Key Event

Why this volatility is not a market correction or a crashIs there a difference between indicators for a market correction and indicators for seeing a larger loss? If different, which indicators are we seeing?

- sam

We got our chief business correspondent Ian Verrender to respond to this one for you:

A correction usually is considered a fall of more than 10 per cent. If it extends to 20 per cent, then that’s what you call a crash.

I was working at the Sydney Morning Herald in October 1987 when we woke up to a 22 per cent drop on Wall Street the previous night.

That was a crash, and it kept on coming for months.

By the time it was over, a few months later, the Australian market had lost close to 50 per cent.

The downturn we’re seeing now, in contrast, has been relatively orderly so far. Losses of between 2 and 4 per cent a day.

And this morning, the worst hit market, Tokyo, has recovered a decent portion of yesterday’s massive 12.4 per cent drop.

What does all this mean for the chances of a recession here? And what does a likely recession mean for todays rates meeting?

- Maria

We had this take from economist Cherelle Murphy this morning on ABC News:

"We've got the Reserve Bank (meeting) coming up today, and I imagine that Michelle Bullock will be peppered with questions (about) this issue.

"And that will provide some guidance, and probably some calming guidance, I would suspect for the markets, as well."

G’day Kate, haven’t got a markets question but recall you’re a Richmond fan? Thoughts on the Dusty news? Cheers

- Punt Road

I'll let her relay her thoughts later. Right now we have stocks to report on.

It can sound scary for investors (or people with their superannuation tied to the stock market) when we hear of big losses on Wall Street or here in Australia.

But this morning, after a two day string of trade that was the ASX 200's worst since 2020, the index is now up marginally.

It is also worth noting that, even with the losses of the past few days, our market is only off about 1.5 per cent since the start of the financial year.

Some US indices are still in the black, giving an indication of just how fast stock markets had been running in recent weeks.

Not everyone has been so lucky, though.

Japan, in contrast, has shed 20 per cent since July 1, although even its market is coming back a bit now.

Where did all that money go? Under the mattress? Behind the lounge cushion? It is funny how money markets can create value out of the thin air of future expectations but suddenly the real economy pays for it when these expectations are not met...

- Bricks and Mortar Type

Key Event

We'll have more for you on superannuation soonWill this have any impact on anybody’s superannuation balance?

- Matt

In short, yes an equities decline will impact superannuation balances because so much super is tied up in the stock market.

But it will depend on exactly where your fund has invested (eg. whether you're invested in a conservative, balanced or high growth option).

It might be worth checking your balances to see what they're doing.

It is also worth noting that your retirement nest egg has not disappeared! And history shows that, like the stock market, it can rebound from these losses.

We'll have some more on super balances today.

A wobbly morning for all.

After opening trade has settled, the ASX 200 is trading down just slightly by 0.08% to 7,643.600.

Which isn't the worst outcome given the last few days...

Proof you can't always pick them off futures.

It's up 0.16% in early trade.

The Australian economist had this gloriously descriptive analogy this morning about what's happening on US markets.

He spoke to ABC's News Channel earlier:

"We're seeing US financial markets very much like toddlers.

They're throwing a tantrum, they're hooting and hollering, they're screaming and yelling, and they're screaming and yelling because they didn't get the rate cuts that they wanted.

Now the thing is, how do you respond to a toddler?

Most of the time, it's just noise, but occasionally, that toddler sees something coming that you may not have seen.

And so I suspect it's noise, and I fear, well, I always think we should listen, just in case there's a little bit more going on, and you've got some context as to just how severe this is."

Key Event

What do you want to know about what's happening on the markets?If you're struggling to get your head around what's happening on the financial markets, you're in the right place.

Here on the blog we firmly believe there's no such thing as a stupid question — so what do you want to know about what's going on?

Send us your questions using the big blue button at the top of the blog, and our team of specialist business reporters will get to answering them for you later this morning.

It is a correction. The market was getting out of hand

- Thiru

Key Event

Why Japan may have more to do with market losses than the US economyYou're going to hear a lot about "yen carry trade" today.

Betashares' David Bassanese spoke to the ABC's Radio National this morning where he explained it very succinctly.

He started off by explaining "the other big thing" besides the fears of US recession that could be worrying investors.

"The Bank of Japan raised interest rates last week, at the same time as people are talking about the US central bank going to start cutting interest rates," he said.

"And that's put upward pressure on the Japanese yen, and a lot of investors around the world borrow yen to buy other things, like US tech companies, US Japanese stocks.

"And so I think the severity of the sell-off in the past couple of days, it tells me that it's not just fear of US recession. It's really just an unwinding of what's called the yen carry trade.

"The Yen has gone up, and people have had to sell out of that position, and as a result, sell everything they've bought with that borrowed money, which is including tech companies.

"So it's that unwinding of that yen carry trade, which is, I think, triggering the severity of the sell offs in the past couple of days."

The unfortunate ramifications of Extreme Greed and Selfishness

- Ricardo Ruiz

"The positive impact of Stage 3 tax cuts appears to be waning," ANZ's Sophia Angala notes.

"(This was) driven by a 4.9pt drop in households' confidence in their own financial conditions over the next 12 months, one of the largest weekly falls for this subindex in 2024 so far.

"However, the boost to disposable incomes from the tax cuts may still be supporting the 'time to buy a major household item' subindex, which rose 1.3pts last week."

How much of a difference a few weeks makes!

Consumer confidence hit a six month high just two weeks ago, but now it's on the decline again, according to the survey done by ANZ-Roy Morgan.

"Weekly inflation expectations rose 0.1pts to 5.1% despite Q2 Consumer Price Index data printing largely in line with the RBA's expectations, alleviating concerns around a potential cash rate hike," ANZ economist, Sophia Angala, notes.

"This would usually be a positive for consumer confidence.

"However, coverage of the heightened recession concerns in the US over the weekend may have offset this."