Is Matrixport To Blame For The Violent Crypto Flash Crash?

Some onlookers blamed the sudden Jan. 3 crypto crash on a Matrixport report claiming the SEC will reject all pending spot Bitcoin ETF applications

The crypto community has been quick to chastise Matrixport, a digital asset investment platform and research provider, for possibly contributing to the violent 6% flash crash that wiped $100B from the crypto market cap on Dec. 3.

A research report published by Matrixport on the same day asserted that the U.S. Securities and Exchange Commission (SEC) will deny all pending applications for spot Bitcoin ETFs. The analysis contrasted against the rampant speculation predicting that the first U.S.-based spot ETF will receive approval in early January, sending digital asset prices flying late last year.

The Block, a crypto news outlet, published an article covering Matrixport’s report, amplifying its reach and leading many analysts to blame the violent market momentum on Matrixport’s analysis.

“Over $1B of Bitcoin futures open interest wiped out in one candle,” Will Clemente, the co-founder of Reflexivity Research, tweeted. “Thanks Matrixport.”

“Bitcoin dumped over a rumor started by Matrixport,” said Lark Davis, a Bitcoin proponent and popular influencer. “Gives you a taste of what would happen if the SEC actually did deny the ETF.”

However, other onlookers are skeptical that Matrixport’s research was the lone catalyst driving the violent market action, pointing to excessive leverage in the Bitcoin markets as evidenced by sky-high funding rates for long positions.

“Funny to see people blaming a Matrixport report for the dump,” tweeted Alex Krüger, an economist and influencer “BTC perps funding on Sunday was almost 100% annualized. That's very rare, the definition of a very hot market. It's down to 10% now (the baseline).”

“Funding rates were historically high before this flush,” said Scott Melker, host of The Wolf Of All Streets podcast. “They have completely reset.”

BTC funding rates. Source: LookIntoBitcoin.Jihan Wu, the co-founder of Matrixport and former CEO of Bitmain, responded to the drama on X, asserting that his company’s management doesn't influence the opinions of its analysts.

“This recent report was prepared for Matrixport's clients,” Wu tweeted. “However, its wide spread by the media was not planned by Matrixport and is beyond our control.”

The debacle came just two days after Matrixport published a different research report on Jan. 1 predicting that a spot Bitcoin ETF would likely receive approval, tipping that the asset could rally more than 15% to surpass $50,000 if so.

Ignas, a popular DeFi analyst, told The Defiant that no single party bears responsibility for the crash.

“The Matrixport report created some [fear, uncertainty, doubt] but other news media and everyone else on Twitter who posted [about it] increased the visibility,” Ignas said. “I believe no one is at fault here. The market was over-leveraged and this drawdown is healthy, if we survive.”

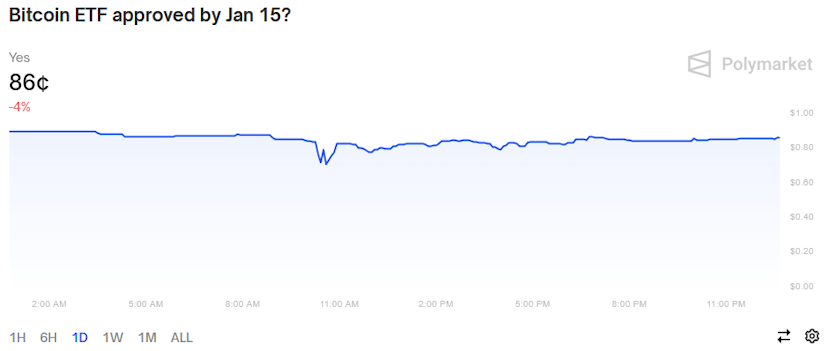

Traders on Polymarket, a decentralized prediction market, are betting there is an 86% probability that the SEC will approve a Bitcoin ETF by Jan. 15, down from a Jan. 3 high of 89%. The market dropped to a low of 70% amid the violent market action.

Odds of Bitcoin ETF approval by Jan. 15. Source: Polymarket.