Monsters of Rock: Record gold prices float all boats for Argonaut ...

Searching for the golden fleece? Argonaut has found it in Aussie gold stocks, ratcheting up its price targets after bullion surged to a new record on Monday.

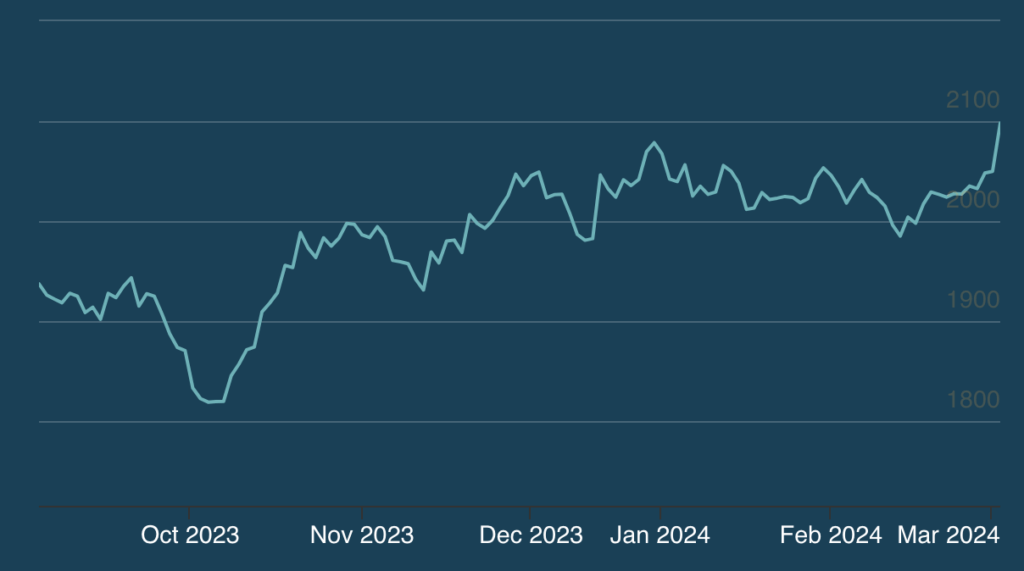

The London Bullion Market Association clocked gold prices at US$2098/oz on March 4, eclipsing the previous record of US$2078/oz set on the last trading day of 2023.

Prices for the safe haven commodity have run almost US$300/oz higher since Hamas’ attack in Israel and its subsequent bombardment of the Gaza Strip.

But it was weak economic data in the US over the past few days, increasing bets on rate cuts starting from the US Fed in June, that gave the real kick over the line.

LBMA closing gold prices have surged by almost US$300/oz since Hamas’ invasion of Israel on October 7. Pic: LBMAIn Aussie dollar terms gold is now trading at $3250/oz, give or take a cent or two move in the USD exchange rate.

That’s sensational for local gold miners, assuming they’ve cleared hedges set at lower prices.

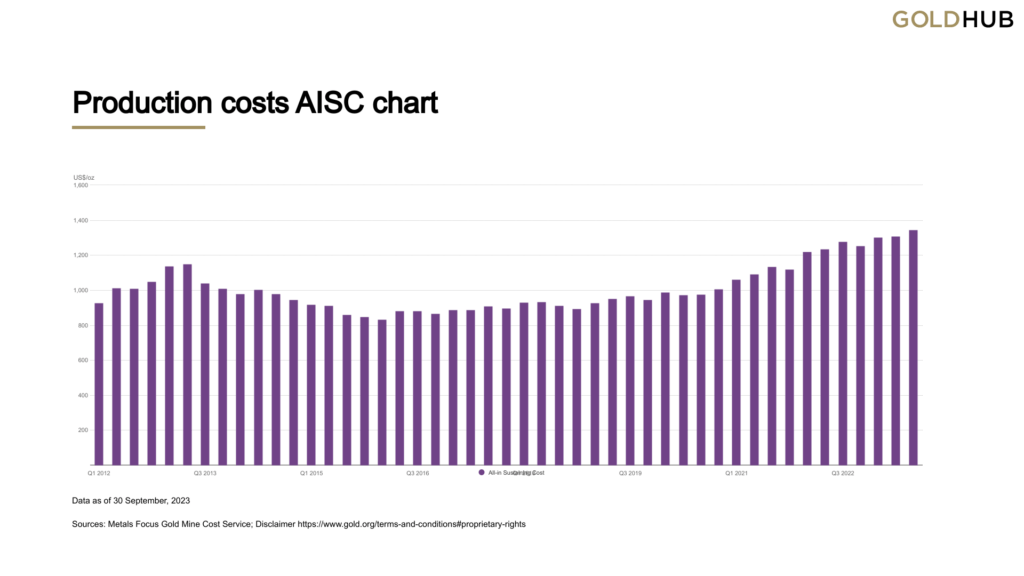

Gold production costs are at record highs, according to figures from the September quarter from the World Gold Council and Metals Focus.

But even at the elevated mean of almost US$1400/oz ($2150/oz), all in sustaining cost margins are over $1000/oz on spot.

Average all in sustaining costs across the gold sector. Pic: World Gold CouncilArgonaut says the price increase brings average quarter to date prices to US$2030/oz, slightly below its US$2050/oz forecast. In Aussie dollar terms it’s up $150/oz in a week, with price targets for 10 ASX stocks under its coverage lifted 3-8%.

“The surge in the spot price is likely to result in the 3QFY24 average gold price being in line with our assumptions, and we have left our earnings forecasts for our Western Australian Gold Miner coverage universe unchanged,” analysts Hayden Bairstow and Patrick Streater said.

“Our price targets for the Western Australian Gold Miner coverage universe are based on a 50/50 weighting of our sum-of- the-parts NPV using Argonaut price forecasts and spot prices.

“Incorporating the stronger spot price drives upgrades to our price targets. We lift our targets for NST, CMM and BGL by3%, GMD and SLR by 4%, RMS, GOR, RRL and RED by 5% and WGX by 8%.”

Who’s got the best leverage?While scale and asset quality is often the name of the game for long term investments, it does not always work that way when it comes to making bets on where you think prices are heading.

Often producers with a more marginal outlook have the best valuation upside.

As a scenario, Bairstow and Streater say adding 10% to its gold price forecasts in perpetuity would drive base case valuations 50% higher for Westgold Resources (ASX:WGX), 45% up for Regis Resources (ASX:RRL) and 30% higher for Red 5 (ASX:RED), which is planning a nil-premium $2.2 billion merger with Silver Lake (ASX:SLR).

Bellevue Gold (ASX:BGL) and Gold Road Resources (ASX:GOR), who each boast a single, high quality asset, are the least sensitive to that shift, up just 13% and 17% respectively.

Ramelius (ASX:RMS) and Silver Lake stand to capture around 25% upside for each 10% lift in the gold price, with Capricorn Metals (ASX:CMM), De Grey (ASX:DEG) and Northern Star (ASX:NST) each at a 2:1 ratio and Genesis Minerals (ASX:GMD) at 2.3:1.

But Bairstow and Streater prefer growth stocks over valuation picks, making ‘sustainable growth’ their clear selection criteria for what they want to see in an ASX goldie.

“GMD and CMM boast the strongest production growth outlooks through FY30 but are trading on the highest FY25 EV/Ebitda multiples,” they said.

“Our lest preferred stocks, SLR and RRL have declining production outlooks.”

Argonaut has buy recommendations on NST (its preferred large cap pick), DEG, CMM, GMD, RMS, GOR, RED and WGX, with holds on BGL, RRL and SLR.

Of those stocks only RMS, SLR, RRL and GOR have underperformed the USD gold price and ASX 200 since Argonaut upped its gold coverage to 10 stocks in January, with all bar those four and BGL outperforming the Australian dollar gold price as well.

A stunning day for gold stocks, with WGX up over 11% a standout, and solid performance from iron ore miners had the ASX materials sector up 0.56%.

The All Ords gold sub-index was up 4.08% today, but remains 6.5% down YTD.

Argonaut gold coverage Mission criticalFederal Resources Minister Madeleine King has supercharged the nickel sector’s call for price bifurcation, issuing the plea to EV customers after meeting with counterparts at the PDAC conference in Canada.

“Australia and Canada have a shared interest in promoting open and transparent markets for critical minerals which are crucial for clean energy technology that will help the world lower emissions and address climate change,” she said in a statement.

“Following our talks in Toronto, our two countries have agreed to advocate for robust ESG credentials to be built into global critical minerals supply chains and drive transparent and traceable supply chains.”

“Prices paid for Australian minerals need to recognise the high ESG standards the Australian industry adheres to and the fact that Australian workers enjoy good working conditions and the highest safety standards.”

The appeal for so-called ‘green premia’ has failed to catch fire with downstream consumers like automakers and battery producers, who are grappling with the core challenge of making battery powered vehicles comparable in price to internal combustion engine cars.

EVs have grabbed increasing market share in recent years leading to a boom in demand and supply of metals like lithium, but there are fears penetration will slow despite government directives once the luxury market is catered for … unless vehicles can become cheaper.

Nickel prices, which are back up to around US$18,000/t after bottoming out below US$16,000/t earlier this year, roughly halved last year as Indonesian producers turned on the taps and flooded the market.

It’s seen a number of western producers shut up shop, saying they can’t compete while around 50% of global nickel supply is lossmaking. Canberra’s need to intervene was accelerated by a warning from BHP it could mothball its Nickel West business, threatening over 3000 current jobs and multi-billion dollar investments in the Kalgoorlie Nickel Smelter and West Musgrave mine in WA.

At the same time, international producers have poured cold water on Canberra’s mission, with Indonesian miner Nickel Industries (ASX:NIC) saying OEMs were concerned about price, not origin or ESG standards.

The International Nickel Study Group last year projected the market would record a 239,000t surplus in 2024, and BHP flagged it expects surpluses of as much as 5% of production into the 2030s before balance is restored. But with prices recently reversing direction that could be overly pessimistic.

Macquarie analyst Jim Lennon has a base case of a 40,000t surplus, but said the market could flip to a deficit this year because Indonesian authorities are slowing the pace of approvals after the South East Asian nation lifted its share of global output from 2-3% in 2015 to ~50% last year.

According to a report from Geoscience Australia launched by King in Toronto, Australia boasts 23% of the world’s economic nickel resources, ranking 1st overall on 2022 numbers.

But it produces just 5%, 5th in the global league table. It produces 52% of the world’s lithium despite being second in overall resources (26%), while it was also the top producer globally of bauxite, iron ore and rutile.

At Stockhead, we tell it like it is. While De Grey Mining was a Stockhead advertiser at the time of writing, it did not sponsor this article

Sponsored Articles