Up to 250 jobs going at KPMG, ASX closes down ahead of RBA ...

Australia's share market closed down on Friday, despite another solid performance on Wall Street overnight as tech stocks drove the S&P500 and Nasdaq to fresh closing highs.

Meanwhile big consultancy firm KPMG is gearing up for job cuts, Elon Musk got a big payday courtesy of Tesla's shareholders, and ASIC demanded extra resources to enforce Australia's corporate laws.

See how the day unfolded on our live blog.

Disclaimer: this blog is not intended as investment advice.

Prices current around 4:30pm AEST

Updates on the major ASX indices:

The index dropped 0.3%.

The All Ords was down by about the same amount.

Have a great weekend everybody!

The wine glut facing Australian grape growers is getting so bad, there's now calls for funding to help vineyards pull out crops.

This week the federal government announced a support package for growers, offering $3.5 million in funding towards growing domestic and international wine sales and providing growers with better data through a national vineyard register.

But Agriculture Minister Murray Watt on Wednesday said funding for growers to exit the industry was unlikely.

You can read more here.

A regional Victorian court has fined global mineral mining company Sibelco $400,000 for exposing four workers to silica dust, resulting in silicosis diagnoses of three men.

Sibelco, which has businesses all over the world, was charged with two counts of failing to provide a safe workplace for the men, who were regularly exposed to "plumes" of silica dust when handling pallets at a Lang Lang quarry in eastern Victoria.

Kevin Weekes was diagnosed with silicosis in 2019, with his doctor phoning him at work to tell him to get his affairs in order.

Read more here.

The Yen has been getting even weaker against the AUD in recent weeks.

$1 will now get you 104 Yen, which for anybody who has been to the Asian nation recently will know, can almost get you an entire can of pre-mixed alcholic soda in a convenience store...

No wonder it's one of Australia's top destination of choice!

For the Japanese, of course, dealing with hoardes of tourists has come with downsides. They've even started banning selfies.

As expected, in a unanimous vote by the board, Japan's central bank hasn't raised rates today.

That means the Asian nation's short term interest rate target will remain officially at 0 to 0.1%, as it continues to battle economic pressures.

In its statement, the BoJ did not that Japan's "economy has recovered moderately" but "weakness" remains.

The central bank has, however, decided to ease off on bond buying.

This story from one of our colleagues, Elizabeth Cramsie.

Burnout continues to be a massive issue for Australian workers and new data shows almost half the workforce is fatigued or burnt out, a new report has found.

Liz Jameson was in her mid 20's when she decided she'd had enough of 12 hour work days.

"I was breakfast radio producer," she says.

"I found the industry very toxic. I ended up changing to work backstage in originally in street theatre (and) now I work in musical theatre as a dress, I work with costumes."

While her new career has her working six nights a week she only works 32 hours in total every week.

And she's not the only Australian looking for work life balance.

"More and more people are looking to have that option and they might only be required in the office 2 or 3 days a week," Paula Brough from the Work Organisation and Wellbeing Research Centre at Griffith University says.

"It's about not doing so much of the unpaid work, the overtime, so they're having more time with their family.

"The whole culture of working long hours in order to be rewarded, for many workers that's losing it's appeal."

And if workplaces want the best staff, they'll need to adapt, she says.

"If you don't have those options for workers who want them they will move, they will leave and go to an employer that does offer that so there's definite economic benefits for flexible work,

It's as a national workplace health survey by UQ has found almost half of Australian workers are fatigued and burnt out, with many contemplating quitting their jobs.

Associate Professor Stacey Parker is an Organisational Psychologist at UQ. She says managing burnout isn't just the responsibility of employees.

"(It's about) organisations in particular making sure that workloads are managable, so people don't feel the pressure to keep working in their downtime. Having that uninterrupted downtime is so important for us to be able to recover.

It comes as the new, right to disconnect laws come into place for non-small businesses later this year, giving workers the right to refuse contact outside their working hours.

Key Event

ASIC calls for extra cash to manage 'explosion' of digital informationASIC appeared before the Joint Corporations & Financial Services Committee this morning.

Its deputy chair Sarah Court was asked by Queensland senator Paul Scarr about whether more cash would help ASIC get more guilty verdict out of its enforcement action.

Ms Court noted that ASIC was receiving millions of documents every year, and they dont have the capabiliy to manage that "explosion" of digital information.

"In my view, the most significant benefit of additional funding would be to enhance our technology capability to improve how efficiently we can interrogate and analyse the vast volumes of material that we receive in any particular matter."

"We are in dire need of a significant tech upgrade to assist our investigators."

You can watch more of the appearance here.

We've had a marginal improvement in trade this afternoon.

The ASX 200 is now trading just 0.3% down.

The index has lost 1.71% for the last five days.

In the same week as a Senate report was released into the use of consultancy firms in Australia, we have big news out of one of the majors.

KPMG Australia says it's "reshaping and simplifying" its consultancy side, while "anticipating future demand".

"Some of the legacy assessment and advice services our firm has offered the market are no longer in the same demand," its national manager partner of consulting, Paul Howes, says in a statement just sent to ABC News.

He notes that KPMG is looking at emerging tech, including AI.

The statement is pretty light on detail, but it does say KPMG is going to "rationalise services and sectors to better reflect market need" to save about $80m annually.

“There will be around 250 roles impacted in some way," Mr Howes says.

It is unclear how many of those 250 people will stay in the building.

"Some teams will transition to other divisions of the firm, and we will be looking to redeploy and upskill as much as possible into areas of high demand, ensuring people with the right skills are in the right places," Mr Howes says.

"Regrettably, there will also be redundancies.”

People impacted should know within the week.

If you're across international finance news, you'll know that in March the central bank in Japan ended the nation's eight-year period of negative interest rates.

Yes, negative interest rates.

Japan's official interest rate is now at 0%. Before you get jealous for their home loan repayments, the reason that the BoJ has been keeping interest rates at this level, is because they have faced major deflationary pressures such as wage stagnation.

The BoJ is meeting again today to decide what to do next.

One economist, Charu Chanana at Saxo, reckons the central bank will keep its short-term target rate unchanged at 0%-0.1%.

I just checked the BoJ's website and it says "undecided" for what time the announcement will come out today.

Keep you posted!

We've got another RBA decision looming on Tuesday.

After a round of economic data last week, ANZ has pushed its prediction of a rate hike from the RBA out to early 2025.

Today we have some crystal balls from CBA, which thinks it will be a "straightforward decision" for the central bank on Tuesday to keep the cash rate unchanged at 4.35 per cent.

CBA believes the latest jobs and GDP data is "largely in line" with the bank's forecasts, and that the latest federal budget, while more expansive than initially predicted, won't change inflation either.

It expects the first "live" meeting won't be until August, and unlike ANZ, Australia's biggest bank is sticking to the prediction that the first rate cut will come by Christmas.

ANZ's economics team has circulated its"macro weekly" note.

It has these interesting passages on Queensland's state budget (which was delivered this week) and how it fits into the national story about cost of living and inflation:

"The Queensland State Budget contained a large ‘cost-of-living package’ worth $3.7bn in 2024-25.

"For perspective, the entire discretionary fiscal easing in the Federal Budget for 2024-25 was $9.5bn, and Queensland has around one fifth of Australia’s population.

"With other states also providing cost-of-living packages, the additional fiscal easing is starting to become material at around ½% of GDP in 2024-25.

"The NSW State Budget is due on Tuesday 18 June.

"Cost-of-living measures will have a large downward influence on Q3 headline CPI, which could show no inflation in the quarter. Trimmed mean inflation should be largely unaffected by these measures, however [NB: 'trimmed mean' refers to the measure of underlying inflation the Reserve Bank focuses on].

"It is highly unlikely that the RBA would cut rates off the back of a low headline CPI print achieved through significant, temporary government subsidies, especially given the risk those subsidies might support consumer demand and, with a lag, higher inflation.

"The RBA typically ‘looks through’ such one-off impacts on inflation.

"Turning to this coming week’s RBA Board meeting (announcement at 2:30pm on Tuesday 18) we expect the cash rate to remain at 4.35%.

Key Event

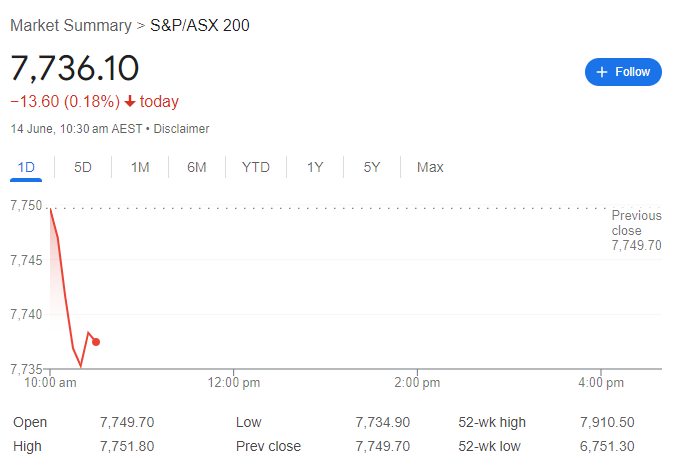

Market down in opening sessionAfter 30 minutes of trading, the ASX200 index has slipped 13.6 points.

Here's more of the story on Tesla's shareholder approval for Elon Musk's record pay package.

There's a discrepancy in some headlines about the size of the package, which has to do with the fact that we're talking about a 2018 package (his 2018 CEO Performance Award) that gave Mr Musk 10 years of performance targets to hit.

That package provided for the payout of stock options when he hit those targets, and people are calculating the value of those stock options differently.

Alicia also spoke to Chris Hulls, the chief executive officer of Life360, the ASX-listed developer of family social media apps.

The company listed on the Nasdaq last week at $27 per share, and it's up 5.5% since then.

Mr Hulls said he'd like to target services to people at every stage of their life cycle:

"If you think about the different range of services you need, from the time you have little kids, or not even having kids at all, to aging parents, we want to fill in all the services in between.

"Elder care is such a huge opportunity, seniors are getting more tech-savvy, their kids in particular are looking for technological solutions ... it's a very natural extension for us to move into things like elder care.

"And we're also just scratching the surface with our devices. The fastest-growing consumer electronics category is locators, and we are very well positioned for that. So, devices for kids, pets, aging parents, it's things that we want to fully own and build in-house."

Last night, my colleague Alicia Barry spoke to Michael Gapen, chief US economist at Bank of America, about the US Federal Reserve's thinking about interest rates.

Mr Gapen said he was confident that inflation in the US was on a "downward trend" and the next move from the Fed would be a rate cut. It's just a question of when.

"We think the Fed cuts in December," he said.

"The Fed is essentially telling us that they think they'll cut later and less [than originally planned], and that's in line with what we're thinking: that policy needs to be more restrictive on average to bring inflation down over time.

"I think the combination of data in the US where actual growth has been strong and the unemployment rate has stayed low, and inflation is coming down but has remained sticky, the response to that, if you're a policymaker, is to say okay we need to maintain our restrictive policy stance for longer to get the macro outcomes we desire."

See the link below for more of the very interesting conversation.

Mr Gapen said the US Fed seems pretty confident right now, but it's still difficult to say precisely when rates cuts will be scheduled.

Wedbush Securities, a wealth management firm based in Los Angeles, thinks Tesla's valuation will now head skywards.

In a note from one of its analysts, they say Tesla's share price (in the US) is currently worth about US$182.71 per share, with a market cap of US$555,065 million.

But they have a 12-month price target of US$275 per share, and their "bull case" is that it'll head towards US$350 per share in the next 12-18 months.

"We believe the next chapter in the Tesla growth story around autonomous and FSD is now on the near-term horizon set to take Tesla's valuation to north of US$1 trillion in 2025 in our view," they say.

They say the shareholder approval for Elon Musk's massive pay package, and for his plan to incorporate Tesla in Texas, have removed a big weight from Tesla's stock.

Key Event

Should we expect to see more job losses this year?If you missed the news yesterday, Australia's headline unemployment declined slightly in May.

It was 4.1% in April, and it slipped to 4% in May, as 40,000 jobs were added and official unemployment declined by 9,000.

But if we look through those monthly headline figures, the trend unemployment rate did rise a little in May, from 3.9% to 4%, to touch its highest level in the post-lockdown era.

Economists suggest that it's a sign that the labour market is "cooling down" in the way that the Reserve Bank has been hoping. But it also means that we should expect to see more job losses as the year unfolds.

My colleague Rachel Pupazzoni put together this very good package on the story:

Key Event

Tesla shareholders approve Elon Musk's US$56 billion payOvernight in the US, Tesla shareholders approved CEO Elon Musk's US$56 billion pay package, along with the proposal to move the company's legal home from Delaware to Texas.

Shareholders also approved other proposals including the re-election of two board members: James Murdoch (son of Rupert Murdoch), and Elon's brother Kimbal Musk.

As per Reuters:

Shareholders did increase the level of investor control by passing proposals in favor of shortening board terms to one year and lowering voting requirements for proposals to a simple majority, despite board opposition to both.

Onstage at the meeting, Musk described himself as pathologically optimistic.

"If I wasn't optimistic this wouldn't exist, this factory wouldn't exist," Musk said to applause. "But I do deliver in the end. That's the important thing."

Musk had tipped off late on Wednesday that the proposals were garnering huge support and thanked shareholders. A chart on his social media platform X showed the resolutions were set to pass by wide margins.

Tesla on Thursday did not disclose the voting tallies, which are expected to be revealed in coming days. At least a half-million viewers watched the meeting on the livestream on social media platform X, and about 40,000 watched on YouTube.

The approval also underscores the support that Musk enjoys from Tesla's retail investor base, many of whom are vocal fans of the mercurial billionaire. The proposal passed despite opposition from some large institutional investors and proxy firms.

But regarding Musk's pay package, it may face some hurdles before it goes through. As per Reuters:

Tesla had been drumming up support for Musk's pay package, especially from retail investors, who make up an unusually high percentage of its ownership base but who often do not vote.

The Tesla CEO could still face a long legal fight to convince a Delaware judge who invalidated the package in January, describing it as "unfathomable".

He may also face fresh lawsuits on the package, which would be the largest in US corporate history.