Live Nation Says It's Not “Legally Permissible” to Break Up the ...

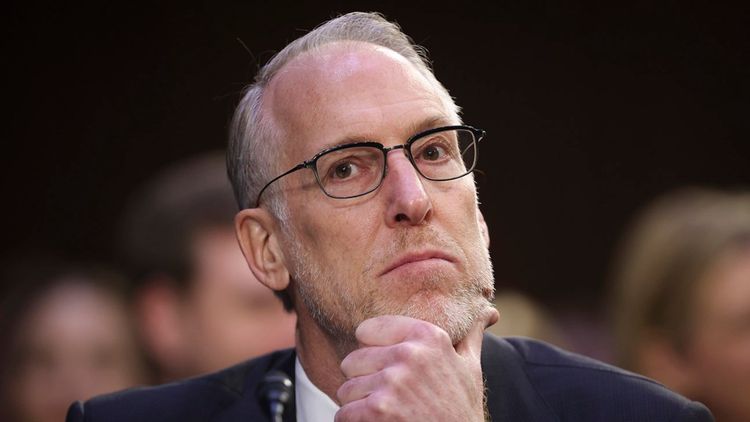

Addressing the potential pending lawsuit from the Department of Justice against Live Nation Tuesday, Live Nation CFO and President Joe Berchtold said the company is about to begin talks with senior division leadership at the DOJ, but that he does not believe separating Live Nation and Ticketmaster will be the end result.

“Based on the issues we know about, we don’t believe a breakup of Live Nation and Ticketmaster would be a legally permissible remedy,” said Live Nation CFO and president Joe Berchtold.

Any lawsuit would typically come after those talks are concluded, he added. But Berchtold reiterated that the company believes the DOJ investigation is more focused on specific business practices, rather than the Live Nation merger with Ticketmaster, which took place in 2010 and was approved by the DOJ.

“Very little of the conduct the DOJ has raised with us relates to the combination of ticketing and promotion resulting from the merger, and most of what does was anticipated and addressed by the consent decree allowing the merger to go forward,” he said.

“We’re looking forward to our upcoming meetings with the division leadership and remain hopeful that we can amicably resolve any remaining disputes. But if not, we’re prepared to defend ourselves in court,” he continued.

On April 15, The Wall Street Journal reported that the Justice Department was preparing to file an antitrust lawsuit against Live Nation as soon as May. The specific claims were not specified, but the Journal reported that the allegations concerned how “the nation’s biggest concert promoter has leveraged its dominance in a way that undermined competition for ticketing live events.”

The DOJ had found in 2019 that Live Nation had been violating the terms of a agreement as part of its 2010 merger with Ticketmaster by forcing venues to accept Ticketmaster’s ticketing services as a condition for hosting Live Nation performers and retaliating against those that refused. As part of that, a monitor was allowed to investigate further breaches of the consent decree until 2025 and the company has been barred from tying services and is subject to a $1 million fine for violations pursuant to oversight from an independent monitor.

However, Live Nation began to face renewed scrutiny after trouble with the sales of the Taylor Swift concert, which also led to a Senate hearing where some argued that it’s a monopoly that should be broken up.

Live Nation also faces a proposed class action lawsuit from investors, who claim the company has misrepresented the scope of its legal troubles to them in light of allegedly abusing its market power in the live events industry.

In the interim, on Thursday, Live Nation reported first quarter revenue of $3.8 billion, up 21 percent year over year, propelled by continued fan demand, alongside an operating loss of $37 million after operating income of $142.7 million a year ago.

Live Nation CEO Michael Rapino attributed the operating income loss to “one-time accruals.”

“Our Q1 results demonstrate that live events remain a priority for fans around the world. Global fan demand is stronger than ever, more artists are out on the road, and more venues are being added to bring them together. While operating income will be impacted by one-time accruals, we’re on track to deliver another record year with double-digit AOI growth and years of momentum still to come,” Rapino said in the press release.

The company said it continues to see continued “strong” demand throughout 2024, with concert ticket sales for overall arena and amphitheater shows pacing up double-digits and more than 85 percent of full-year shows at large venues booked, compared to approximately 75 percent last year. Arenas and festivals led fan growth of 21 percent to 23 million fans in the first quarter of the year.