Live: ASX slips following Wall Street losses, Qantas shares down ...

The ASX 200 opened lower on Friday after Wall Street saw a dip, reflecting the upcoming meeting of the US Federal Reserve next week.

Airport delays are expected as more than 500 Qantas engineers walk off the job today until Saturday over a wage dispute.

Follow the day's financial news and insights from our specialist business reporters on our live blog.

Disclaimer: this blog is not intended as investment advice.

Key Events

RBA keeping an 'open mind' to how economy is evolving

2 hours agoFri 13 Dec 2024 at 2:59am

ASX trading lower at lunch

3 hours agoFri 13 Dec 2024 at 2:00am

ASX opens lower

5 hours agoThu 12 Dec 2024 at 11:27pm

3h agoFri 13 Dec 2024 at 1:54am

Prices current around 12:50pm AEDT.

Live updates on the major ASX indices:

7m agoFri 13 Dec 2024 at 5:03am

What will happen to the economy in 2025?Leading economists say 2024's economic conditions centred on the impact of interest rates being used to tame inflation, and cause a 'per capita' recession.

The ongoing strength of the jobs market was a surprise, with high employment meaning people were stretched by rising costs, but most were able to keep making their commitments.

Interest rate cuts are expected to begin in 2025, with the economy set to be dominated by a weak Chinese economy and potentially erratic trade conditions prompted by US President Donald Trump.

Economists expect unemployment will rise in 2025.

Daniel Ziffer talks to independent economist Nicki Hutley, Challenger chief economist Jonathan Kearns, AMP deputy chief economist Diana Mousina and UBS Australia chief economist George Tharenou — watch here:

32m agoFri 13 Dec 2024 at 4:38am

Iron ore on track for a weekly lossIron ore futures retreated on Friday and were on track to end the week lower, as top consumer China's latest vows of further stimulus to shore up its faltering economy failed to impress investors.

The most-traded January iron ore contract on China's Dalian Commodity Exchange ended morning trade 1.3% lower at 795.5 yuan ($US109.34) a metric ton.

The contract has dipped 0.06% so far this week, snapping a three-week rise.

"Markets were highly disappointed at the lack of concrete specifics from China's Central Economic Work Conference, given such a promising start to the week from... the Politburo," said Atilla Widnell, managing director at Navigate Commodities.

The letdown came despite Chinese authorities signaling the fine print on policy would be released in and around March 2025, Widnell added.

Beijing pledged on Thursday to increase its budget deficit, issue more debt and loosen monetary policy as it braces for heightened trade tensions ahead of a second Donald Trump presidency.

The remarks came in a readout of top Chinese leaders' annual Central Economic Work Conference, held on December 11-12.

"With the recovery path for China still bumpy... we'll struggle to see a long-term move higher for iron ore prices," ING analysts said, adding that this will continue until the market sees signs of sustainable economic recovery and growth.

Also pressuring ore prices are high portside stocks, standing at above 150 million tons — the highest ever for this time of the year, ING said.

1h agoFri 13 Dec 2024 at 4:02am

Wool production tumbles to lowest level in a centuryWool production is set to fall to its lowest level in more than 100 years for the year ending 30 June 25.

The Australian Wool Production Forecasting Committee is predicting wool production will fall 12 per cent for the 2024-25 financial year, to less than 280 million kilograms.

In a concerning sign for the industry, wool production hasn't been that low since 1920-21.

At the same time, the number of sheep shorn is expected to fall 11.7 per cent to 63.2 million.

To put that in perspective, Australia's sheep flock peaked at around 180 million in the 1970s.

The wool industry is facing pressure on numerous fronts, including poor wool prices and low returns, and competition for land use from cropping and meat production.

The worst hit state is Western Australia, where both sheep shorn and wool production are forecast to fall 18.8 per cent.

It comes as live sheep exports will be banned by 2028, which has been an essential market for WA farmers.

1h agoFri 13 Dec 2024 at 3:30am

Fed to cut next week and three times next year: ANZHere's some commentary from ANZ economists, ahead of next week's US central bank meeting.

Brian Martin & Tom Kenny from ANZ Research wrote:

We expect the Federal Open Market Committee (FOMC) will cut the fed funds rate (FFR) 25bp this month and signal that it will be appropriate to slow the pace of easing in 2025.

We expect three more 25bp cuts in 2025.

We judge the recent stalling in inflation is transitory.

Nonetheless, future caution on rate cuts is warranted.

The possible impact of Trump 2.0 policies on prices is unclear.

It will be appropriate for the Fed to take time to understand the potential effects of new government policies on inflation.

Private sector job creation has slowed, and the labour market is weaker than pre-pandemic.

This argues that the FFR trend remains down.

We will be monitoring how the labour market evolves under the new administration.

Key Event

2h agoFri 13 Dec 2024 at 2:59am

What a week it has been for Reserve Bank watchers.

First, on Tuesday, the central bank kept rates on hold but changed its language in a way that had many forecasters seeing the door very much open to an interest rate cut in Februrary.

However, on Thursday, the latest jobs data came in much stronger than had been expected, leading to more bets on rates staying on hold until later meetings.

In Adelaide, RBA assistant governor Sarah Hunter is delivering a speech on how the central bank uses scenarios to inform its economic forecasts.

"As forecasters, [scenarios] can help us think through and communicate risks around our baseline.

"For example, by identifying which risks the forecast might be particularly sensitive to, and the balance of risks around the central case.

"They can also help us keep an open mind about alternative explanations for how the economy is evolving," Dr Hunter said.

You can read the full story from David Taylor here:

2h agoFri 13 Dec 2024 at 2:38am

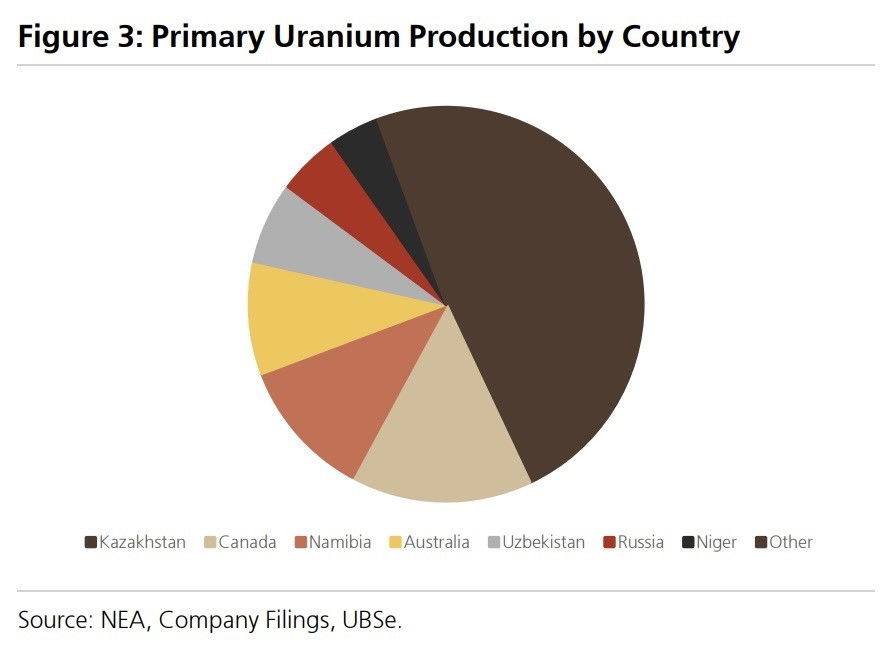

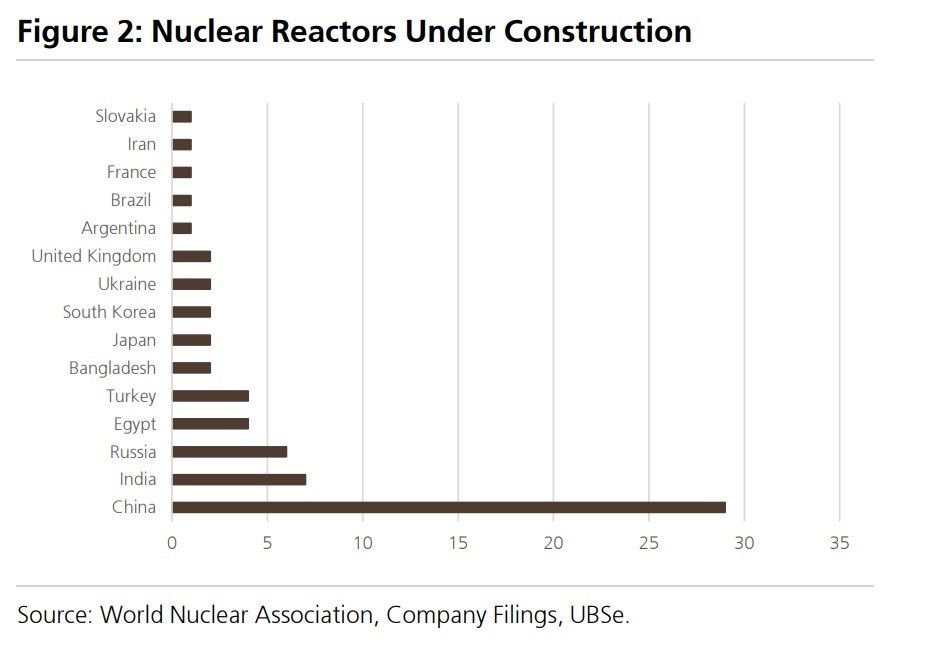

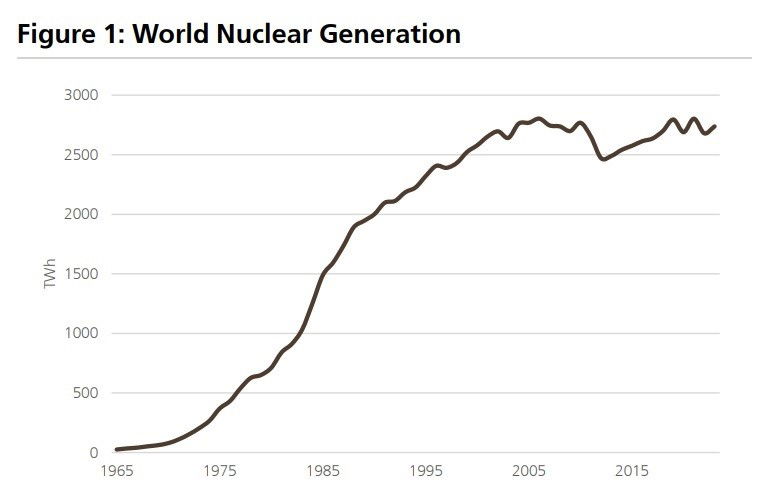

Uranium by the numbersFollowing on from our analysis of uranium prices in 2025 via the folks at UBS, I thought these charts were quite illustrative of the global market (all via UBS):

If you're wondering where it's all coming from, a few countries dominate:

And in terms of what's on the horizon - one country is leading the way for nuclear reactor construction:

Overall, here's the state of play globally for nuclear generation:

2h agoFri 13 Dec 2024 at 2:15am

Momentum gathers for uranium, but Trump, supply factors present riskWhat does 2025 have in store for uranium prices? UBS has released this note, saying increased interest for nuclear energy is likely to bode well for uranium - but there are some risks.

"2024 was a false dawn for the uranium market with the spot uranium price down 15% YTD (year to date) as buyers remain on the sidelines and still without urgency to procure near-term. What do we expect for 2025? While we remain structurally positive the medium/long term outlook, we are less convinced that supply-demand impulse shifts materially in the immediate future. We lower our CY25/26 U price forecasts 9/6% to US$78/80/lb ahead of a more detailed analysis of the commodity. This sees us push EPS downgrades through both PDN / BOE. However, we believe the equities have overcorrected and remain BUY-rated on the stocks."

"2024 saw a continued lift in interest in nuclear energy as a long-term clean energy source. While COP 29 nuclear outcomes were more incremental in nature than structural for the global nuclear thematic (compared to COP 28), the near-synchronous announcements of several U.S. tech majors (META, AMZN, MSFT, GOOG) to invest/ pursue nuclear-backed solutions for the sector's (AI-related) energy requirements was a boost to sentiment, though we question near-term demand impacts. Looking specifically to 2025e, we see global nuclear reactors growth and thus U consumption lifting ~3-4% with new reactor growth led by China and India while also noting the Palisades restart in the U.S. In contrast, we forecast supply growth at closer to 6-7%, taking into account Kazatomprom looking to lift volumes 12% from 2024 to ~25000- 26500ktU, along with a number of smaller supply additions (including PDN & BOE). Separate from our assessment of supply/demand growth, we are cognizant of several considerations which deserve continued focus into next year including: a) the U.S. demand outlook under Trump's presidency, b) continued supply risks around Niger (~4% of global production), c) broader industry impacts of the continued Russia-U.S. enriched uranium trade row, & d) NXG's emerging contracting activity and its impact on broader sentiment."

Key Event

3h agoFri 13 Dec 2024 at 2:00am

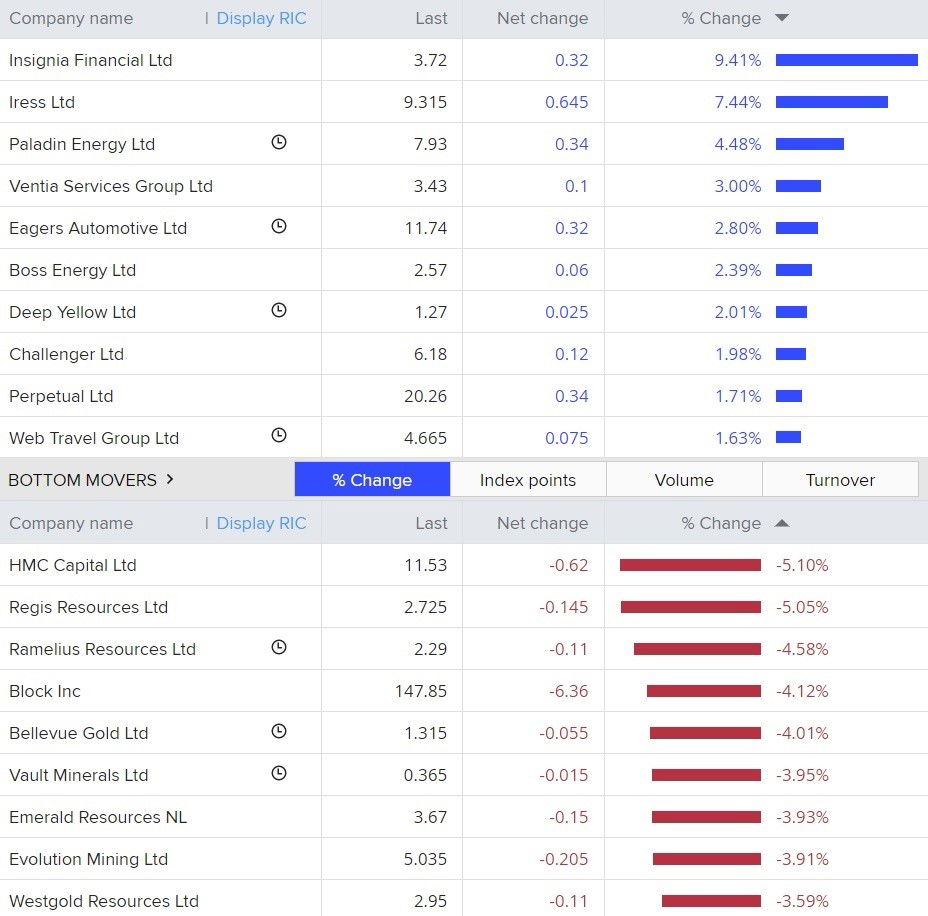

The Australian share market has been falling this afternoon, with the ASX 200 down 0.68% at 12:58pm AEDT.

All sectors are in the red except education and energy.

Here are the top and bottom movers on the ASX 200 this lunch time:

3h agoFri 13 Dec 2024 at 1:34am

Do you have a side hustle?The cost of living is biting and — especially with all of the expenses this time of year — we're hearing more people are picking up a second job.

If you have a side hustle, I'd love to hear about it. I'm working on a story about why people are picking up second jobs in the current economic climate and what sorts of work people are doing.

If you're happy to be interviewed and have your photo taken for an online story please leave a comment with your contact number.

3h agoFri 13 Dec 2024 at 1:18am

More reactions to the Coalition's nuclear planHere's some more commentary on the Coalition's nuclear plan.

To be clear, there is still a lot that is unclear about the plan.

Basically, experts say without seeing the assumptions behind Frontier Economics' modelling the nuclear plan is based on, it's impossible to fully assess whether it stacks up or not.

Director of Clean Energy Finance Tim Buckley is definitely not a fan of nuclear.

This is some of what he had to say about the Coalition's nuclear plan when he was on ABC News Radio this morning:

"What they start with is conflating the energy cost of living crisis that we have now with renewables, and they're winning the media war by cherry picking facts that are unrelated.

The energy prices went up because of Putin invasion in Ukraine and the oil price, the gas price and the coal price doubling.

That's what's caused everyone's energy prices in Australia to go up."

Tim Buckley says renewable energy is going to drive costs down.

"And that is exactly what the Australian Energy Market Commission put out a massive report last month saying they're forecasting energy prices in Australia will go down 13% over the next decade because of the development of renewable energy."

"We're already at 44.6% renewable penetration across the national electricity market.

We can have a look at what the biggest energy developer in the world is doing, China. China has built 236 gigawatts of wind and solar in the last 10 months, they've built 1.2 gigawatts of nuclear.

They're doing an all of the above strategy. They're the biggest energy developer in the world, and nuclear is 1/200 of the capacity, which means it's about 1/80 of the generation that China has built just in the last 10 months. America does not have a single nuclear power plant, even at final investment decision, let alone under construction. They have 2600 gigawatts of wind, solar and batteries in the investor queue. America is all in on renewables. China's all in on renewables."

Buckley described nuclear as a fantasy that would drive up energy prices. The Coalition, of course, disagrees with that.

4h agoFri 13 Dec 2024 at 12:58am

Qantas shares lower as workers strikeI'm checking in as one of your co-pilots for the afternoon of blogging ahead.

So let's start with a quick check on how Qantas is travelling so far this session.

Shares are currently down 2.3 per cent — so the stock is underperforming the broader market by quite a bit.

That's as hundreds of engineers and maintenance workers are on strike seeking a better pay deal with the airline.

However, major airports are reporting 'business as usual' so far.

In other airline news this week, Virgin began selling tickets for its increased European schedule yesterday, despite its Qatar tie-up still awaiting final approval.

Qantas shares may be down for the day but since January they've gained nearly 64 per cent.

Qantas shares since Jan 2024(LSEG Refinitiv)4h agoFri 13 Dec 2024 at 12:34am

More holes in Coalition's nuclear plan - Tony WoodSome more comments from the Grattan Institute's Tony Wood.

Wood said the other big assumption with the Coalition's nuclear plan was that it would avoid a lot of new transmission costs.

"You’re still going to need a lot of transmission, because they've still got 54% of energy coming from renewables in 2050.

"So, understanding what assumptions they've made to generate some of the big cost differences is fundamental to say whether or not you think one of these is more likely the other."

Wood also points out that the nuclear plan will not make energy bills cheaper anytime soon.

He said next year would be a "cost-of-living election" and nuclear energy was not going to improve the cost of electricity "next year or the year after or the year after".

4h agoFri 13 Dec 2024 at 12:29am

'A hope and a prayer': Grattan Institute's Tony Wood sceptical about Coalition's nuclear planThe Coalition said its plan to build taxpayer-owned nuclear power stations would be $263 billion cheaper than the cost of Labor’s renewables policy, which the federal government rejects.

Grattan Institute's Energy Program director Tony Wood spoke to business reporter Rhiana Whitson and said without knowing the assumptions the Coalition and the firm it hired to produce its nuclear plan modelling, Frontier Economics, it was impossible to say if that comparison stacked up.

On the Coalition’s nuclear plan, Tony Wood says coal would have to keep running for longer, and the Dutton plan assumes that won't cost that much.

That’s despite Australia’s ageing coal power stations becoming increasingly unreliable in recent years.

“What happens to nuclear doesn't arrive in the 2035-2036? Well, we’ll be keeping coal running even longer, and not only will the cost of the coal go up, the emissions go up even higher, because we slow down the move towards renewables, to keep the coal running longer.

So there are some big questions there."

Key Event

5h agoThu 12 Dec 2024 at 11:27pm

The Aussie sharemarket has opened lower on Friday as expected off the back of losses on Wall Street.

All sectors fell at the open with the exception of education which was up +0.5%.

Software company Iress led the top movers gaining +6.8%, followed by Insignia (+5%) and Arcadium (+1.6%).

The bottom movers at the open included Ventia Services which fell -4.8%, Vault Minerals down -4.6% and Polynovo (-4.2%).

5h agoThu 12 Dec 2024 at 11:15pm

Westpac AGM to cover fossil fuel financingWestpac is under pressure from shareholders to stop investing in fossil fuels.

A report from Market Forces earlier this year found Australia's big four loaned $3.6 billion to fossil fuel companies and their projects in 2023.

Market Forces has joined 100 Westpac shareholders in lodging a resolution that's set to be voted on at Westpac's annual general meeting today, demanding the bank demonstrate how its fossil fuel financing aligns with its commitments to the Paris Agreement.

Westpac chairman Steven Gregg has released his opening address to the ASX.

In it, he addresses fossil fuel investment and says he recognises "shareholders hold differing views on this issue".

"To deliver sustainable value to shareholders, Westpac must balance the interests of a wide range of stakeholders.

"Tackling climate change and supporting the transition to a low-carbon future is one such expectation. We are committed to taking action towards net-zero by 2050, reducing our greenhouse gas emissions, and building resilience against the impacts of climate change for a cleaner, more sustainable future."

Mr Gregg says the bank's "exposure to fossil fuels has been declining in recent years", down 11% this year.

And 87% of its lending to electricity generation is directed towards renewable energy such as wind, solar and hydro.

6h agoThu 12 Dec 2024 at 10:59pm

Lower unemployment, stagnant inflationPaul Bloxham, chief economist at HSBC has weighed in on yesterday's jobs figures that showed the unemployment rate has fallen to 3.9%.

Bloxham says the data shows Australia's labour market may be tightening rather than loosening and that declines in unemployment suggest strength in the labor market, with public sector job creation playing a significant role.

He said the figures are a positive for the RBA which can claim it has continued to deliver a jobs market that is close to full employment.

At the same time, if the jobs market is no longer loosening, this should raise concerns that it could be quite hard to get core inflation to continue to fall towards its target.

6h agoThu 12 Dec 2024 at 10:41pm

Does nuclear pass the pub test?The nuclear debate is back on the agenda today with the Coalition presenting modelling suggesting its nuclear policy would cost more than $300 billion.

But the party argues it's a cheaper option than Labor's renewables proposal.

Energy Minister Chris Bowen says the opposition's policy is "a fantasy".

7h agoThu 12 Dec 2024 at 10:00pm

ASX 200 futuresIn this morning's Market snapshot: "ASX 200 futures: +0.1% to 63.73 US cents" This doesn't look like an ASX 200 future quote.

- Malcolm

Right you are Malcolm - that was a typo.

ASX futures are currently at 8,290 points, down -0.7% at 9am.

7h agoThu 12 Dec 2024 at 9:33pm

Crypto exchange Kraken to pay $8m penaltyThe Federal Court has ordered the Australian operator of Kraken crypto exchange to pay $8 million for unlawfully issuing a credit facility to more than 1,100 customers.

Business reporter Rhiana Whitson spoke with Kraken's Australian MD Jonathon Miller ahead of the penalty decision.

Mr Miller called for more regulation around crypto, to provide clarity for the industry, arguing Australia is lagging.

You can read that full store here: