Live updates: RBA expected to leave interest rates on hold at 4.35 ...

The Reserve Bank has kept interest rates steady at 4.35 per cent at the conclusion of its two-day policy meeting, as widely expected.

The Australian share market has risen after US mega-cap technology stocks drove Wall Street's benchmark index, the S&P 500, to a fresh record high.

See how the trading day unfolds on our blog.

Disclaimer: this blog is not intended as investment advice.

Prices current around 12:30pm AEST

Live updates on the major ASX indices:

Speaking to ABC News Channel earlier, EY economist Cherelle Murphy added that it's not just inflation that could force the RBA's hand on potential rate increases at its next meeting in August.

She noted that the revised stage 3 tax cuts, which come into effect on July 1, could affect consumer spending — which the RBA would take into account in its August meeting.

"Then, of course, as we look into the second-half of the year, we also have tax cuts to think about, real wages are rising again," Ms Murphy said.

"Will all of the factors together cause the consumer to actually feel better and start spending again?

"It is possible, so it's definitely not an easy time to be a central banker in 2024."

She added that global economic uncertainty — including tension in the Middle East and the war in Ukraine — are also having an impact on the RBA's outlook for inflation.

Key Event

'There is a risk that the Reserve Bank could hike again'That's according to EY economist Cherelle Murphy, who was speaking to finance presenter Alicia Barry on ABC News Channel a short time ago.

With the RBA keeping rates on hold at 4.35% for another meeting, attention now turns to the August meeting — which will come after the June quarterly inflation data flows through.

Ms Murphy said if inflation remains quite strong in the June quarter, there is a chance the central bank could push rates up again.

"If it [inflation] didn't follow the path that the Reserve Bank predicts in its forecasts, and moves substantially above that, then yes — certainly, there is a risk that the Reserve Bank could hike again," she said.

"However, there are also a number of factors which, of course, might work the other way, so we're going to have to wait and see what that number looks like."

Cherelle Murphy from EY.(ABC News)Key Event

'Inflation is easing' but 'more slowly' than RBA would likeIn its post-meeting statement, the RBA says that while inflation is coming down, it is at a much slower pace than it would like to see.

"Inflation is easing but has been doing so more slowly than previously expected and it remains high," the statement said.

"The Board expects that it will be some time yet before inflation is sustainably in the target range. While recent data have been mixed, they have reinforced the need to remain vigilant to upside risks to inflation.

"The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out."

The statement adds that the board remains "resolute in its determination to return inflation to target and will do what is necessary to achieve that outcome".

Key Event

RBA keeps rates on hold at 4.35 per cent for another meetingAs expected, the Reserve Bank of Australia has kept interest rates at 4.35 per cent for the fifth-straight meeting.

It means the central bank has left rates unchanged for seven months in a row.

The central bank hasn't increased rates since November 2023, and rates currently at their highest level since November 2011.

Key Event

Economists predict RBA will leave rates at 4.35pc againThe overwhelming majority of economists polled by Reuters are expecting the RBA will keep rates steady at 4.35% again after its latest meeting.

Refinitiv data shows 97.1% of surveyed economists expect no change to the cash rate, while the remaining 2.9% are predicting a rate hike of 0.25 percentage points.

The RBA last increased rates by 0.25 percentage points in November 2023, taking the cash rate to the current level of 4.35%.

It's the highest rates have been since November 2011 — and if rates stay at 4.35% again today, it'll be the seventh-straight month that rates have been at this high.

Key Event

???? Where to watch the RBA's interest rates decisionFor all the action — and reaction — from the RBA's latest interest rates decision, you can watch our rolling coverage using the ABC's dedicated live stream below.

(Alternatively, you can watch the same stream at the very top of the blog.)

Key Event

Coming up: The RBA's latest interest rates decisionWe're just under half an hour away from finding out what the RBA's decided to do with interest rates after its fourth meeting this year.

All will be revealed at 2:30pm AEST with a post-meeting statement from the central bank's board.

Then we'll hear directly from RBA governor Michele Bullock when she fronts up to a press conference explaining the decision an hour later at 3:30pm.

Stay with us here on the blog, and we'll bring you the latest as it happens.

(And feel free to let me know your thoughts by leaving us a comment using the big blue button at the top of the blog.)

Key Event

Buy now, pay later services to be examined in RBA payments reviewAhead of the central bank's rates decision in about an hour, the RBA has announced plans to review retail payments regulation once the updated laws pass through parliament.

The review — which will consider forcing buy now, pay later (BNPL) services to allow its merchants to pass on costs to retail customers — would begin as soon as the federal government passes laws that would give the central bank greater oversight of digital payment methods.

The RBA's head of payments policy, Ellis Connolly, told a conference in Melbourne that BNPL services cost merchants around 3.5% the value of the purchase, "which is well above the cost of card transactions".

"Most BNPL services do not allow merchants to pass on the cost to consumers through surcharging," he said.

"Surcharges could be used by merchants to signal to consumers that they are using a relatively expensive payment method."

He added that the RBA decided in 2021 that merchants should be allowed to surcharge BNPL services.

The RBA estimates that the value of BNPL transactions was around $20 billion in 2023, or equivalent to 2% of card purchases in Australia.

The comments come after the federal government introduced legislation that would require BNPL providers to hold an Australian credit licence, and be subject to regulation by ASIC.

You can read Mr Connolly's full speech here.

Key Event

Why Fortescue has slid to a near-eight month low todayFortescue is the biggest loser on the local share market so far today, down 4.5% to $21.94 per share.

It's recovered slightly from earlier in the day, when it fell by as much as 5.5% to $21.72 — it's lowest level since October 25 last year.

But what's the reason behind the company's decline?

It's got to do with a story in the Australian Financial Review, which reports that an institutional investor has sold a stake worth $1.1 billion in a block trade.

The AFR also reports that JP Morgan was appointed as the bookrunner for the deal, with more than 61.6 million shares changing hands for $21.60 apiece.

Neither Fortescue or JP Morgan has commented on the report in the AFR.

Reuters also reports that Fortescue's share prices is 20.8% lower this year, as of the last close.

Key Event

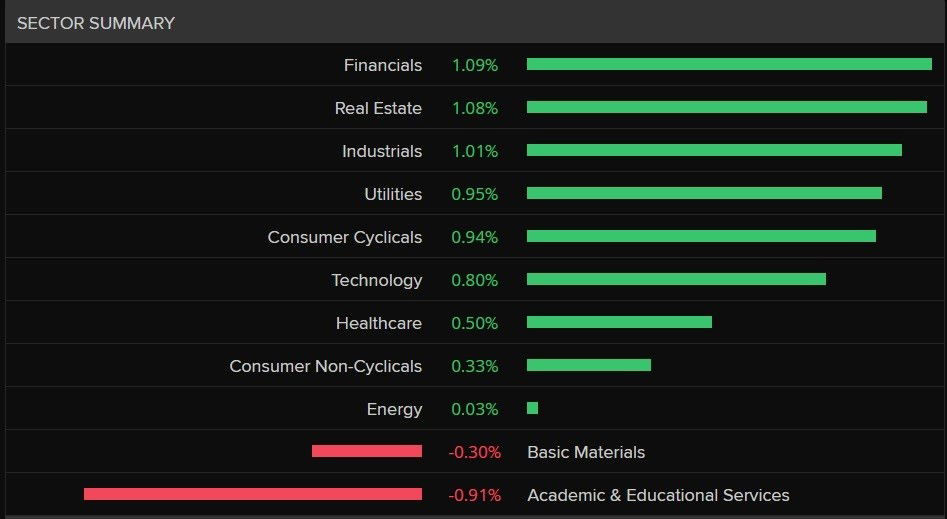

Local shares gain at lunchtime as investors wait for RBA decisionAs we hit lunchtime, the ASX 200 has continued to charge ahead. Currently it's 0.9% higher to 7,772 points as of 12:30pm AEST.

(Remember you can get live figures any time at the very top of the blog.)

Looking at the sectors, only one is in the red — education, which is down 0.9%.

Leading the gains are utilities (+1.8%), financials (+1.4%) and real estate (+1.2%).

But overall, markets are poised and ready for the RBA to unveil its latest interest rate decision at 2:30pm AEST.

(Spoiler alert, but they're expected to remain on hold at 4.35%.)

As for the top performing stocks:

Atlas Arteria +3.8%Sigma Healthcare +3.1%Charter Hall Group +3%Macquarie +3%Liontown Resources +3%And the bottom performers:

Fortescue -4.6%Beach Energy -2.9%Alumina -2%Iluka Resources -1.8%Lynas Rare Earths -1.1%Key Event

Adobe sued for allegedly 'trapping' customers with hidden feesThe US government is suing Adobe (the company behind the Photoshop and Acrobat software) for allegedly harming consumers with hidden, exorbitant termination fees, and making it hard to cancel subscriptions.

The Federal Trade Commission will argue that Adobe buries the fees (which sometimes reach hundreds of dollars) and other important terms in its "annual paid monthly" subscription plan — in the fine print, or behind textboxes and hyperlinks.

If a customer wants to cancel the subscription early (and within the first year), Adobe sets the termination fee as 50% of remaining payments, according to the complaint filed in the San Jose, California, federal court.

In addition, subscribers who want to cancel online are allegedly made to navigate unnecessarily through numerous pages.

And the regulator claims those who are trying to cancel by phone are often disconnected, forced to repeat themselves to multiple representatives, and are often met with "resistance and delay" from those representatives.

Two Adobe executives are also being sued by the FTC in this litigation — David Wadhwani (president of Adobe's digital media business) and Maninder Sawhney (senior vice president in digital sales).

"Adobe trapped customers into year-long subscriptions through hidden early termination fees and numerous cancellation hurdles," said Samuel Levine, director of the FTC consumer protection bureau.

"Americans are tired of companies hiding the ball during subscription signup and then putting up roadblocks when they try to cancel."

Adobe said it will defend the matter in court.

Subscriptions accounted for $US4.9 billion (or 95%, of Adobe's $US5.2 billion revenue in the March quarter).

UBS will set aside around $900 million ($1.36b) to repay people who invested in Credit Suisse funds, which were linked to the failed supply chain financing firm Greensill Capital.

That accounts for 90% of what these investors are owed, according to UBS (which is the owner of Credit Suisse).

Here's what Reuters is reporting about the latest in the Greensill saga:

"The bank [UBS] has been seeking to resolve issues it inherited when it acquired Credit Suisse last year after a string of financial problems brought down its long-time rival.

Among them, was a 1.6 billion Swiss franc ($US1.8b) loss due to the collapse of $US10 billion in supply chain finance funds linked to Greensill in 2021.

Also known as reverse factoring, the supply chain finance deals, portrayed as low-risk, allowed companies to get cash from banks and funds such as Greensill Capital to pay suppliers.

UBS said the Credit Suisse Supply Chain Finance Funds have made an offer to buy back units or shares in the fund from the fund's investors.

"Fund investors who choose to accept the offer will be redeemed at 90% of the Net Asset Value determined on 25 February 2021, net of any payments made to the fund investors since then, through newly established feeder subfunds."

Credit Suisse has recovered some of the funds, although around $US2.5 billion is outstanding, fund disclosures show.

"UBS AG expects to record a provision of around $0.9 bln on a consolidated basis in connection with the offer in 2Q24," it said in a statement.

The amount will be taken from the $US4 billion the bank set aside for potential litigation and regulatory costs when it took over Credit Suisse.

If you want a refresher on the Greensill collapse, and the man behind the company, Lex Greensill, here's the story by Four Corners:

Key Event

Lithium, banking and healthcare stocks drive ASX higherToday's best performing stocks are from a broad range of sectors.

They include lithium miner Liontown Resources (+4%), Seven Group (+3.1%), Macquarie Group (+2.6%) and ALS (+2.2%), formerly known as "Australian Laboratory Services".

On the flip side, mining and energy stocks are dominating the list of worst performers, including Fortescue (-5.1%), Beach Energy (-4.2%) and gold miner Red 5 (-2.8%).

158 stocks on the ASX 200 index are trading higher.(Eikon)Key Event

ASX opens higher, led by financials and property sectorsThe Australian share market is off to a solid start, following a record-breaking close on Wall Street overnight.

The ASX 200 index was up 0.6% to 7,748 points by 10:25am AEST.

Nearly every sector is trading higher, led by financials (+1.1%) and real estate (+1.1%).

However, the biggest drag on the market is the materials sector (-0.3%).

The ASX is getting a boost from most sectors.(Eikon)When Chinese Premier Li Qiang inscribed his message in the visitor's book at Parliament House, he emphasised "the friendship between China and Australia is evergreen".

The statement marked a significant shift because it was the first time in nearly a decade that a Chinese official had openly described the bilateral relationship as a "friendship" — a word Prime Minister Anthony Albanese mentioned as he walked off the aeroplane in Beijing last year.

Despite a minor diplomatic faux pas where Albanese mistakenly referred to Li as his deceased predecessor — Li Keqiang — the overall tone of the visit was overwhelmingly positive.

Terms like "renew", "revitalise", "get back on track" and "evergreen friendship" filtered through the discussions, signalling that the relationship was nearly restored.

However, these celebratory outcomes were largely premeditated.

For more, here's the latest from Bang Xiao:

China has launched an anti-dumping investigation into European Union pork products, just a week after the EU decided to slap a 38 per cent tariff on Chinese electric vehicles.

China and the EU are the world's top two largest pork producers. However China still imports pork products from the EU, with Spain and the Netherlands being the top two suppliers.

Last week, the European Commission concluded Chinese-made EVs benefitted from "unfair subsidisation", and applied a range of tariffs on Chinese brands like BYD (17.4 per cent), Geely (20 per cent). SAIC (38.1) per cent, starting on 4 July.

China's anti-dumping investigation will begin immediately, and focus on pork products for human consumption like fresh, cold and frozen whole cuts, as well as pig intestines, bladders and stomachs.

Russia, Brazil and Argentina could help fill any gaps in the Chinese market left by a reduction in EU imports. The USA is another major port exporter to China, although its products are subject to a 25 per cent duty.

More than 700 Victorians have waited more than a year for their claim to be resolved by the state-run insurer after their builder went bust, adding to emotional and financial pain for distressed families.

The state's ombudsman is being urged to investigate the Victorian Managed Insurance Authority's (VMIA) behaviour, following this week's ABC Stateline report that detailed allegations that the authority was forcing low and unrealistic building quotes onto desperate families.

In some cases the offer would not cover the completion of construction or a full remedy of defects.

The VMIA provides domestic building Insurance (DBI) in the event a builder is unable to finish the works — often due to insolvency. It is a statutory government body that reports to the Assistant Treasurer Danny Pearson.

New data from Freedom of Information documents obtained by the state opposition also shows that the number of outstanding claims jumped to 1,682 in April, up from 1,359 in January.

Here's the latest story by Richard Willingham:

Key Event

NSW Treasurer Daniel Mookhey set to hand down budget forecasting years of deficitsThe New South Wales government is forecasting four more years of deficits in Tuesday's budget, after a change to how money from the GST is distributed shattered hopes of a return to surplus.

Treasurer Daniel Mookhey is also warning there'll be little additional cost-of-living relief for families because he's concerned handouts could stoke inflation.

Instead of the $475 million surplus forecast in the half-yearly review, the treasurer will announce a $3.6 billion deficit for the next financial year.

While the government is blaming an $11.9 billion shortfall in expected GST revenue, Treasury's own calculations show the state was still heading for a $1.9 billion deficit in 2024-25 even under the previous assumptions.

For more, here's the story by Nick Dole and Tony Ibrahim:

Key Event

What to expect from the Reserve Bank's interest rate decisionHere's what economists from some of Australia's largest financial institutions are expecting to hear from the RBA this afternoon.

Taylor Nugent (NAB senior economist):"The RBA is expected to remain on hold with little change to the post meeting statement or the guidance from Governor Bullock in the post meeting press-conference, where the recent mantra has been "not ruling anything in or out.

"There are no new forecasts at this meeting and the recent run of data has been broadly in line with May forecasts.

"The RBA has the luxury of waiting until the full Q2 CPI [second quarter consumer price index] on 31 July before their next forecast update at the August meeting."

Ben Jarman (JP Morgan chief economist):"The guidance that the board “is not ruling anything in or out” is likely to remain, as is the statement that it will be “some time yet” before inflation is sustainably back at the target.

"The more dovish remarks will likely relate to offshore matters, particularly ongoing weakness in China and geopolitical risks, though we expect the global theme of sticky services inflation will be mentioned again as a cautionary tale."

Diana Moussina (AMP deputy chief economist):"The cash rate is expected to be held at 4.35% (with all economists looking for no change to interest rates) but more importantly will be the commentary in the post-meeting statement and press conference.

"The economic data since the last meeting in May has mostly been in line with the RBA’s expectations.

"The 2024-25 Federal Budget and state budgets released so far have been probably had more spending then the RBA would have liked to see but the Fair Work Commission decision around minimum wages was a tad lower than expected.

"So all up, there is no reason for the RBA to changes its assessment that the current stance of monetary policy is appropriate but that they cant rule anything “in or out” in terms of interest rates.

"The board will probably debate the merits of a rate hike at the meeting but this is not a sign that the RBA is willing or ready to raise interest rates again.

"We continue to expect the next move to be a rate cut around the end of the year."