ASX closes 0.7pc higher, WiseTech board reviewing Richard White ...

The local share market closed 0.7pc after Wall Street's key indices hit fresh record highs on Friday, spurred on by tech stocks and a solid batch of corporate results.

In corporate news, Qantas is facing the prospect of a hefty compensation bill to workers sacked during the pandemic, while the board of WiseTech Global says it is "monitoring" the scandal surrounding founder Richard White.

The company shares slumped almost 15pc wiping almost $2 billion off Mr White's holding.

Look back at the day's events.

Disclaimer: this blog is not intended as investment advice.

Key Events

ASX gains 0.7%, Wisetech and Mineral Resources crash

14 hours agoMon 21 Oct 2024 at 6:35am

ASX up 0.6%, WiseTech and Mineral Resources hammered

18 hours agoMon 21 Oct 2024 at 2:33am

Qantas compensation bill to sacked workers could rise substantially

20 hours agoMon 21 Oct 2024 at 12:59am

15h agoMon 21 Oct 2024 at 5:28am

Prices current around 4:30pm (AEST)

Live updates on the major ASX indices:

14h agoMon 21 Oct 2024 at 6:44am

GoodbyeThat's it for another day on the ABC's markets blog, thanks for your company.

But remember the ABC business team rarely sleeps ... ok, so we sometimes rest our eyes during particularly tedious webcasts, but that's about it.

The Business with Nadia Daly in the chair tonight will be back on ABC News at 8:45pm and after the Late News on ABC-TV.

"Downtown" Dan Ziffer will be back and blogging on the early shift tomorrow.

Until next week, au revoir.

Key Event

14h agoMon 21 Oct 2024 at 6:35am

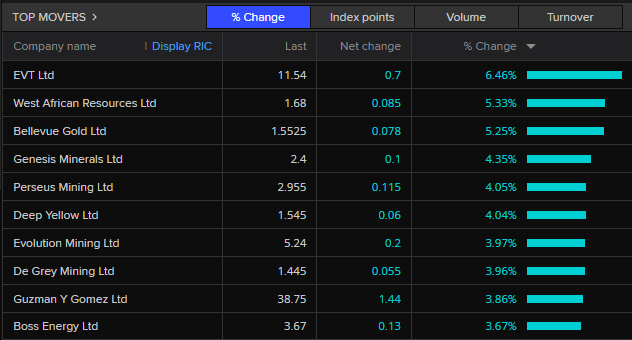

The ASX 200 closed 0.7% higher following a strong lead from Wall Street, but that didn't mean it was all smooth sailing with a couple of high-profile stumbles today

Australia's most valuable tech-stock, WiseTech, tumbled 14.6%, or $17.83 to $104.65 after the company's board confirmed it was looking into allegations about the personal life of billionaire founder and CEO, Richard White.

Mineral Resources also fell sharply, down 13.8%, after its board said it was looking into allegations surrounding its billionaire founder and managing director Chris Ellison and his tax arrangements.

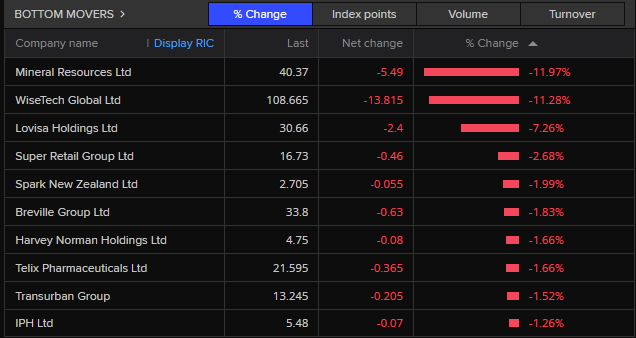

ASX 200 bottom movers(LSEG,ASX)The biggest winner was Amotiv (the company formerly known as G.U.D.) up 10.2% after a positive update at its AGM this morning and the announcement of a share buy-back.

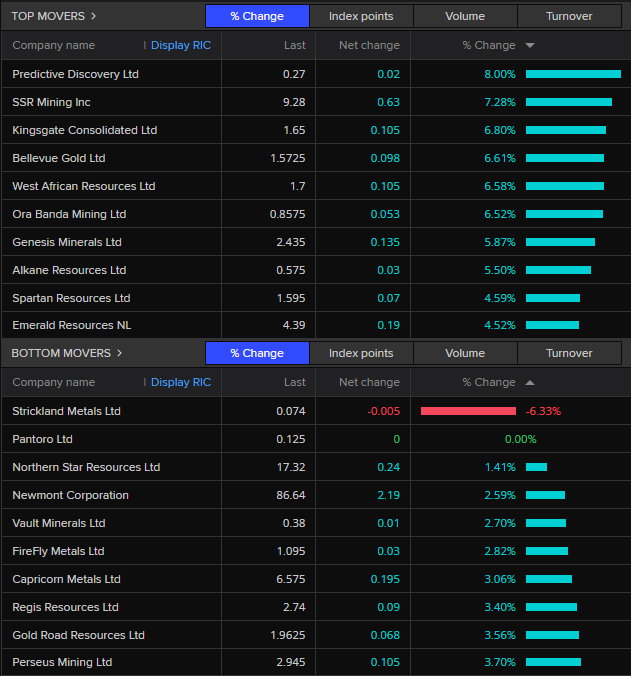

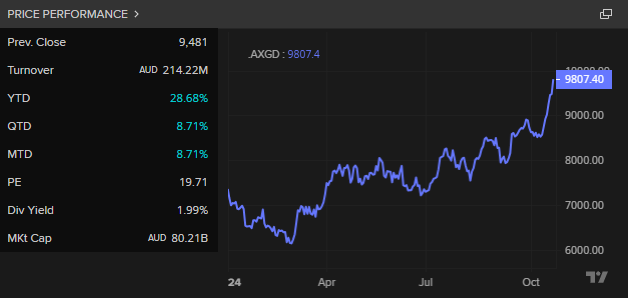

As a sub-sector, the best performers on the ASX 200 were goldminers with Bellevue Gold (+5.9%), West African Resources (+7.2%) and Genisis Minerals (+7.4%) leading the way, with overall ASX gold index up 3.7%.

ASX 200 top movers(LSEG, ASX)The iron ore miners (ex-Mineral Resources) lifted after iron ore prices jumped 1% on Friday - Fortsecue (+1.5%), Rio Tinto (+1.9%) and BHP (+1.4%) made steady gains across the day.

The banks were a bit mixed with CBA (+1.1%), NAB (+0.6%) and Westpac (+0.3%) ending in positive territory, while ANZ (-0.3%) slipped.

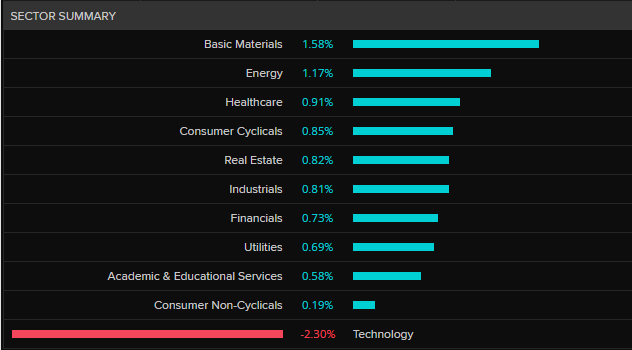

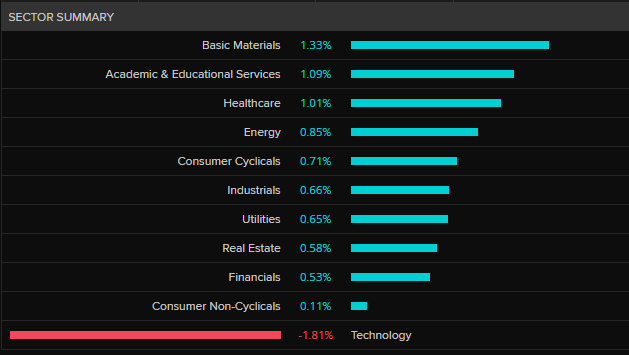

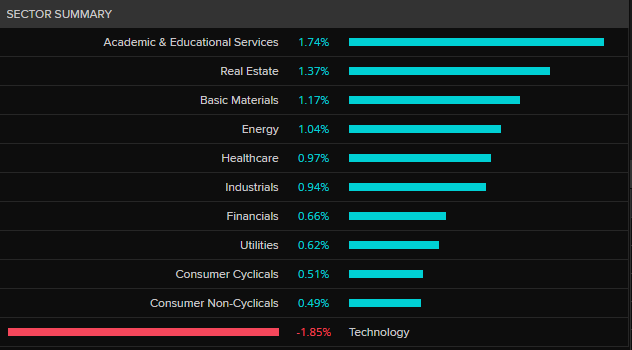

The only sector in the red was technology, not a surprise given WiseTech's fall and weighting in the sector.

Across the region both Shanghai (+1.2%) and Japan's Nikkei (+0.1%) made a positive start to the week while Hong Kong's Hang Seng (-0.6%) didn't.

The Australian dollar was marginally weaker.

Futures trading points to a relatively flat opening on Wall Street tonight.

15h agoMon 21 Oct 2024 at 5:21am

Regulator deluged with complaints after CBA and Westpac's technology failuresHas the recent spate of big bank stuff-ups - app outages at Westpac and St George and CBA's duplicate transaction doozy - made things so precarious in our financial lives that we need two banks to offset the risk of a crash at one?

Well one financial expert thinks it does (too bad if you choose CBA and Westpac to lay off your bets last week).

Business reporter Stephanie Chamers spoke to Professor Elizabeth Sheedy from the Macquarie Business School about the recent bank meltdowns and what customers can do to mitigate risk.

16h agoMon 21 Oct 2024 at 5:00am

On The Business tonight with Nadia DalyHere's what's coming up on The Business tonight with Nadia Daly:

Nadia Daly talks to Thomas Taw, APAC Head of Investment Strategy at world's biggest asset manager BlackRock.Chief business correspondent Ian Verrender discusses the events at WiseTech and Mineral Resources which has seen both companies' shares tank as their boards open investigations into the actions of their billionaire founders.and Emilia Terzon looks at the Federal Court decision which is likely to cost Qantas millions in settlements to illegally sacked workers.Catch The Business on ABC News at 8:45pm, after the late news on ABC TV, and anytime on ABC iview.

16h agoMon 21 Oct 2024 at 5:00am

To paraphrase Oscar Wilde, "to lose $1 billion may be regarded as a misfortune, to lose almost 2 billion looks like carelessness."

That's the sort of day the billionaire founder and CEO of Australia's biggest tech company WiseTech, Richard White has endured.

Since the Nine Newspapers published some fairly salacious allegations this morning concerning Mr White's personal life, and the Wisetech board issued a statement to the ASX saying it "is currently reviewing the full range of matters raised in today's media reports and is actively seeking further information and taking external advice", it's been one way traffic for the company's share price - steeply downhill.

With a $16.32 drop in share price (at 3:30pm AEST), Mr White's 114,970,958 shares are now worth roughly $1.9 billion less than they were at the start of the day.

Fortunately, liquidity shouldn't be an issue as Mr White has cashed in roughly $100 million in shares over the past fortnight, as per ASX notifications.

The news for Mineral Resources billionaire founder and MD, Chris Ellison is marginally better - he's down only $138 million today across his three separate holdings of Min Res stock after his board said it would be looking at Mr Ellison's historic tax arrangements.

16h agoMon 21 Oct 2024 at 4:28am

US earnings season rolls on, Wall Street to open flatThe US earning season has so far beaten expectations.

It has been supporting the recent rally, although the last 6 days of record highs is part of an on-going trend that has seen the S&P 500 hit a record high 47 times so far this year.

The S&P 500 may make it 48 tonight, but it's hard to tell with the futures market pricing in a flat opening, up just 2 points, or 0.03%.

S&P 500 companies reporting this week include:

Mon: SAP, Logitech

Tue: Verizon, GM, 3M, GE Aerospace, Texas Instruments

Wed: Boeing, AT&T, Coca Cola, Tesla, IBM, Newmont

Thu: American Airlines, UPS, Nasdaq

Fri: Colgate Palmolive, Aon

Just a word of caution though from AMP's head of investment strategy, Shane Oliver.

"The key risks are that valuations are stretched particularly for US tech stocks, the risk of recession remains high in the US and Australia, the expansion of the war in the Middle East threatens to impact oil supplies and a Trump victory in the US election (with polling moving his way) could spark fears around another trade war," Dr Oliver said.

17h agoMon 21 Oct 2024 at 3:33am

Local gold stocks booming todayFollowing on the piece on CBA forecasting gold has further rally, local gold miners are having a glittering session today.

Only one of the 25 miners on the ASX gold index is in the red (the heavily shorted Strickland Metals) while most have put on 3% or better.

ASX gold index top and bottom movers today(LSEG, ASX)So far, the ASX index has put on around 30% this year.

ASX gold index (YTD)(LSEG, ASX)17h agoMon 21 Oct 2024 at 3:24am

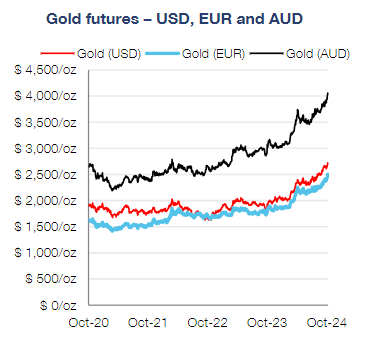

Gold heading for $US3,000/ounce next year: CBAHaving whipped through $US2,700/ounce and gaining more than 30% this year, the CBA says the rally is not about to end any time soon.

Veteran CBA commodities analyst Vivek Dhar has adjusted his spread sheet and now sees gold futures averaging $US2,800/oz this quarter based on the US dollar falling around 2% from spot levels.

Given that the US dollar and gold typically have a negative relationship, and the CBA forecasts a persistently weaker greenback, Mr Dhar has forecast gold will average $US3000/ounce in the fourth quarter, 2025.

"We see upside risks to our outlook given gold's ability to find support indifferent financial market conditions so far this year," Mr Dhar said.

"We have been particularly surprised at the lift in gold prices during periods when the US dollar has strengthened.

"The key tailwind on our radar is the potential positive impact of falling US 10-year real yields on gold prices as the FOMC rate-cutting cycle continues.

"We are less positive on safe haven demand being a sticky driver but acknowledge that a worsening conflict in the Middle East will likely provide some support for gold prices."

18h agoMon 21 Oct 2024 at 2:46am

Kohler on carbon creditsJust to change gears for a moment, our finance whizz-in-residence, Alan Kohler, put together this handy explainer on carbon credits for the 7pm news last night.

If you didn't catch it then (1) why didn't you? (2) you can now - entirely worth 1min 58 seconds of your time

Key Event

18h agoMon 21 Oct 2024 at 2:33am

The ASX 200 is 0.6% higher following a strong lead from Wall Street, but that doesn't mean it is all smooth sailing with a couple of high-profile stumbles this morning.

Australia's most valuable tech-stock WiseTech has tumbled 11.3%, or $13.82 to $108.66 after the company's board confirmed it was looking into allegations about the personal life of billionaire founder and CEO, Richard White.

Mineral Resources also fell sharply, down almost 12%, after its board said it was looking into allegations surrounding its billionaire founder and managing director Chris Ellison and his tax arrangements.

The biggest winner so far is Amotiv (the company formerly known as G.U.D.) up 10.7% after a positive update at its AGM this morning and the announcement of a share buy-back.

As a sub-sector, the best performers on the ASX 200 have been goldminers with Bellevue Gold (+5.9%), West African Resources (+6.4%) and Genisis Minerals (+5.2%) leading the way.

The iron ore miners (ex-Mineral Resources) have lifted after iron ore prices jumped 1% on Friday - Fortsecue (+1.8%), Rio Tinto (+1.5%) and BHP (+1.4%) have made steady gains across the morning session.

The banks are a bit mixed with CBA (+1.0%), NAB (+0.5%) and Westpac (+0.1%) all in positive territory, while ANZ (-0.1%) has slipped.

The only sector in the red is technology, not a surprise given WiseTech's fall and weighting in the sector.

ASX 200 by sector(LSEG, ASX)Across the region Shanghai is up 0.7%, while Japan's Nikkei (+0.1%) and Hong Kong's Hang Seng (+0.2%) have also made positive starts to the week.

The Australian dollar is marginally firmer.

19h agoMon 21 Oct 2024 at 2:02am

Market snapshotPrices current around 1pm (AEST)

Live updates on the major ASX indices:

Key Event

20h agoMon 21 Oct 2024 at 12:59am

The $170,000 payout to three Qantas workers illegally sacked during the COVID-19 pandemic were effectively "test cases" for another 1,700 workers stood down at the time.

While it will be up to lawyers from the airline and the Transport Workers' Union to work out a final compensation figure, it doesn't require much imagination to see a figure in the millions being paid out.

With more, here's a piece just filed by colleague Kate Ainsworth who has been following developments this morning.

20h agoMon 21 Oct 2024 at 12:30am

Not all good publicity is good publicity ...The old adage that all publicity is good publicity sometimes has a fairly hollow ring to it on the ASX, so it's worth checking out what's happening with this morning's headline acts.

WiseTech: -11.4% on news the board is investigating allegations about billionaire founder and executive director Richard Wise's personal life.

Mineral Resources: -10.8% on news the board is investigating allegations about billionaire founder and managing director Chris Ellison's tax arrangements.

Transurban: -1.5% subject of tonight's Four Corners' program.

Qantas: +1.5% on news it could face a hefty compensation bill for workers illegally sacked during the pandemic. I guess where rules are concerned, there is an exception to every exception.

Key Event

20h agoMon 21 Oct 2024 at 12:16am

Qantas has been ordered to pay $170,000 in compensation to three workers who were illegally sacked during the COVID-19 pandemic.

Last year, the High Court ruled that the airline broke the law when it stood down 1,700 ground crew members in August 2020.

At the Federal Court in Sydney this morning, Justice Michael Lee ruled that Qantas would be required to pay varying degrees of compensation based on three "test cases".

Justice Lee ordered that the three workers would be awarded compensation of $30,000, $40,000 and $100,000 respectively for "non-economic loss".

However, lawyers for both the airline and the Transport Workers' Union will be required to determine a final compensation figure for the income lost by the 1,700 sacked staff, limited to 12 months after their roles were outsourced.

The ruling means Qantas is set to face a substantial compensation bill worth tens of millions of dollars.

The matter will return to court in November.

21h agoSun 20 Oct 2024 at 11:56pm

Tabcorp and Super Retail Group face shareholder scrutinySpeaking of the Mayne Report, we put in a call to its founder, owner and come to think of it, entire staff, Stephen Mayne to check out his thoughts on the AGM season.

Mr Mayne knows a thing or two about AGMs having asked questions at around 850 and counting, which is testimony to not only his shareholder activism, but human endurance.

This is his hot take on the run.

The 88% vote against Perpetual's remuneration report was just staggering last week and there have also been surprisingly large protests against individual directors, which is a feature we're likely to see more of this season.

Former AFL CEO Gillon McLachlan will be on debut and under the pump at Tabcorp's hybrid AGM in Sydney on Thursday and the legal saga at Super Retail Group will also play out when it fronts shareholders in Brisbane on Thursday.

Curiously, Qantas have run off to Hobart for this week's AGM on Friday but they are unlikely to suffer a second strike after cancelling more than $10 million worth of executive bonuses since last year's strike.

It is very disappointing that some of the biggest companies are refusing to offer online voting and questions this season including Origin Energy last week and BHP, Fortescue, Harvey Norman and Seven Group in the weeks ahead.

Key Event

21h agoSun 20 Oct 2024 at 11:49pm

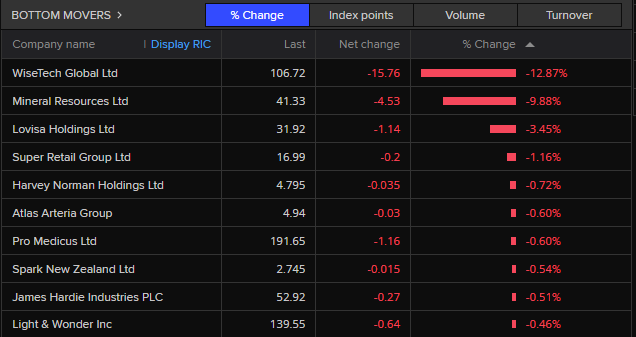

The ASX 200 has opened 0.8% higher following a strong lead from Wall Street, but that doesn't mean it is all smooth sailing with a couple of high-profile stumbles this morning.

Australia's most valuable tech-stock WiseTech has tumbled almost 12.8%, or $15.67 to $106.94 after the company's board confirmed it was looking into allegations about the personal life of billionaire founder and CEO, Richard White.

Mineral Resources also fell sharply, down almost 10%, after its board said it was looking into allegations surrounding its founder and managing director Chris Ellison and his tax arrangements.

ASX 200 bottom movers(LSEG, ASX)The biggest gainers on the ASX 200 have been goldminers with Bellevue Gold (+6.1%), West African Resources (+5.4%) and Genisis Minerals (+5.2%) leading the way.

The iron ore miners (ex-Mineral Resources) have lifted after iron ore prices jumped 1% on Friday - Rio Tinto is up 1.3% and BHP has gained 1.1%

The banks are still in favour, all gaining this morning with NAB (+1.1%) and CBA (+0.9%) leading the way.

ASX 200 top moversThe only sector in the red is technology, not a surprise given WiseTech fall and weighting in the sector.

21h agoSun 20 Oct 2024 at 11:19pm

Market snapshotPrices current around 10:20am (AEST)

Live updates on the major ASX indices:

Key Event

22h agoSun 20 Oct 2024 at 11:02pm

Further to our earlier post on WiseTech founder and CEO Richard White, the company's board confirmed it is investigating allegations raised in media reports published in Nine Newspapers this morning.

In a statement to the ASX, the WiseTech board noted it was looking into, "further media coverage today regarding Chief Executive Officer and Executive Director, Richard White, including an historical claim."

"The board is currently reviewing the full range of matters raised in today's media reports and is actively seeking further information and taking external advice.

."The Board will continue to meet regularly to consider and monitor the situation, and keep the market updates in line with its continuous disclosure obligations," the statement said.

The Australian Financial Review and other media outlets reported that a woman who had a sexual relationship with the billionaire chief made a raft of claims against Richard White in late 2020, including allegations that he had engaged in inappropriate behaviour.

As we reported earlier, Mr White has also sold around $100 million worth of shares in the company over the past fortnight.

For a deeper dive into the current problems the tech billionaire is enduring, it is well reading a piece from chief business correspondent Ian Verrender, published over the weekend.

22h agoSun 20 Oct 2024 at 10:33pm

Corporate calendar: AGM season heats upMon: Argo, Amotiv/GUD, Nick Scalli, Stockland

Tue: Audinate, Globe, Magellan, Peter Warren Automotive, SG Fleet, Shine Justice, Suncorp, Transurban

Wed: Fletcher Building, National Storage REIT,Mystate, St Barbara

Thu: APA, Articore, Brambles, Challenger, Deterra, IAG, McMillan Shakespeare, Reece, Reliance Worldwide, Santana Minerals, South 32, Super Retail Group

Newmont (Q3 results), Resmed (Q1 results)

Fri: Adairs, Aussie Broadband, Car Group, Cleanaway, Cochlear, Coventry Group, Helloworld, Qantas

On the reckoning of The Mayne Report's website's excellent AGM page (indeed the whole website is a terrific rabbit-hole to wander around) there are more than 50 AGMs being held by Australian and Australian/NZ dual listed corporations this week.

You can start your week with Argo Investments, assuming you can get to Adelaide by 10am today (no online option) and wrap up with Car Group at 11am Friday in Melbourne, somewhat jet-lagged having flown back from Zimplats AGM in Johannesburg on Thursday evening.

There's the threat of a bit of bloodletting by irate shareholders at a couple of meetings, the most obvious being Globe on Tuesday.

The streetwear/skateboarding fashion business has its virtual AGM booked in for 10am and scheduled a spill AGM for 11:30, so it seems the board knows what's heading its way.

The troubled fund manager Magellan is also facing a spill motion (Tuesday) after last year's remuneration report rejection but may escape having the board defenestrated on the basis that at least some changes have been made to way things operate, and executives are paid.

Challenger (Thursday) is facing a vote against its remuneration report and the Long-Term Incentive bonuses being offered to its CEO.

There are a couple of companies with dual Australian/US listings releasing quarterly results as well.

Newmont, the giant US goldminer with a local CDI listing after swallowing Newcrest reports on Thursday, as does the San Diego-based sleep apnoea specialist, Resmed.