Ripple (XRP) Price Forecast: XRP eyes $0.80 breakout amid ...

On November 13, Ripple (XRP) price crossed the $0.75 mark for the first time in 2024. On-chain data trends suggest the majority of current XRP holders are anticipating more gains.

While the majority of crypto traders bet on Donald Trump to win the November 5 presidential election, Ripple (XRP) founders donated over $11 million to the Kamala Harris campaign.

In effect, XRP price lagged behind the broader crypto rally in the aftermath of Trump’s landslide win.

While the likes of BTC, Dogecoin and Solana price had increased by more than 50% within a week of the election, XRP price recorded a subdued 25% gain, as it rejected the $0.65 resistance on November 11.

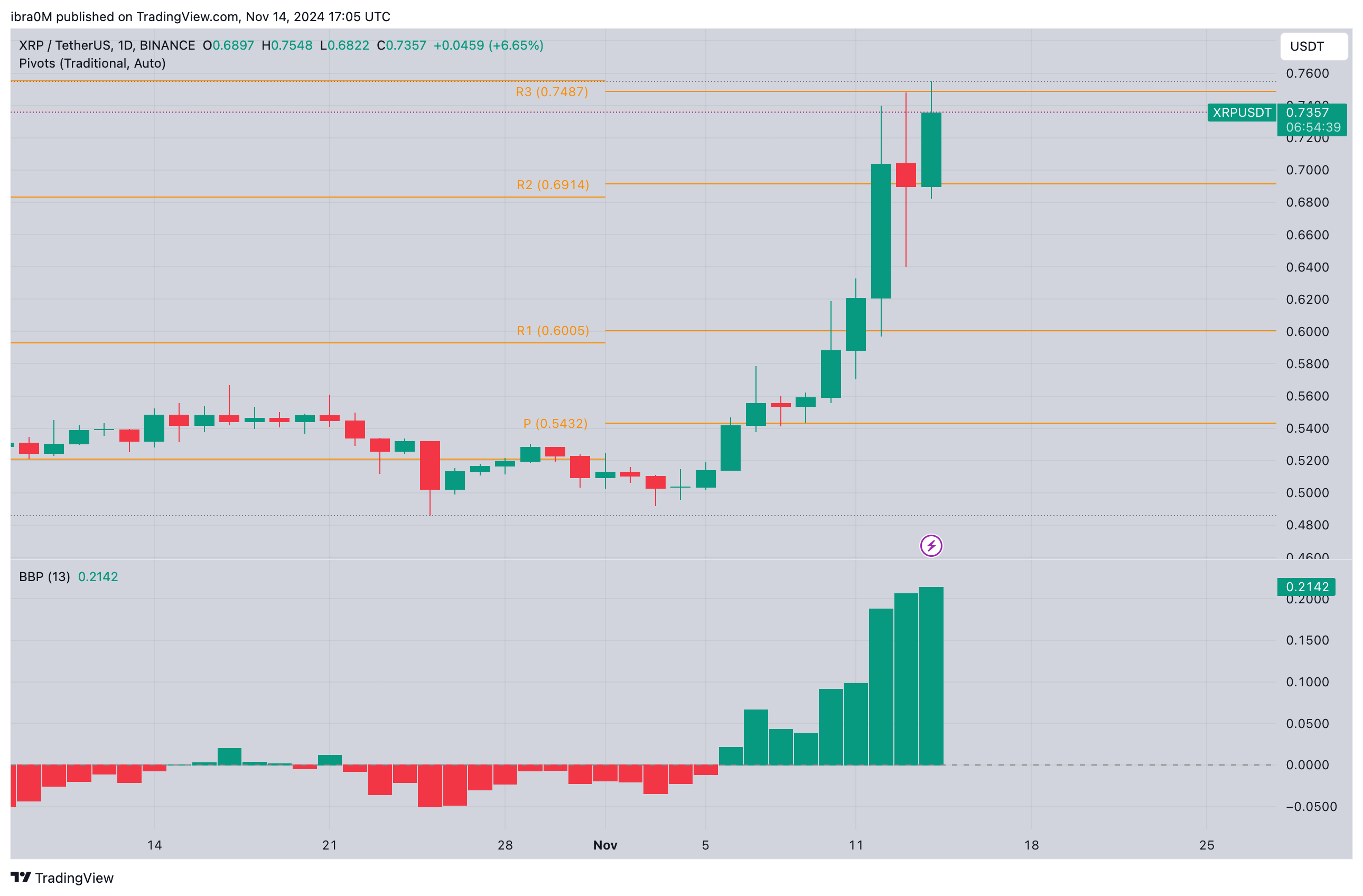

Ripple (XRP) price analysis | TradingView

The chart above shows that the global altcoin market cap grew by 33% between November 5 and November 11, highlighting XRP’s initially lagging price performance.

However, on November 13, market sentiment turned positive after Robinhood announced the listing of XRP, Solana and Cardano.

This listing reflects a significant shift in the US regulatory stance as major crypto platforms had previously delisted these altcoins following the SEC’s 2023 lawsuit against Binance and Coinbase that accused these assets of being unregistered securities.

With Trump’s election victory, the incoming administration is expected to replace SEC Chair Gary Gensler with a more crypto-friendly candidate. Consequently, the re-listing of XRP and other large-cap altcoins signals growing anticipation of a positive shift in the US regulatory landscape for cryptocurrencies when the new administration takes office in January 2025.

In effect, XRP price has instantly surged by another 22% since the Robinhood listing announcement, reaching a new 2024 peak of $0.76 on November 14.

Looking beyond the price action, on-chain movements observed in the last 48 hours suggest the Robinhood listing has triggered increased confidence in XRP’s long-term price prospect.

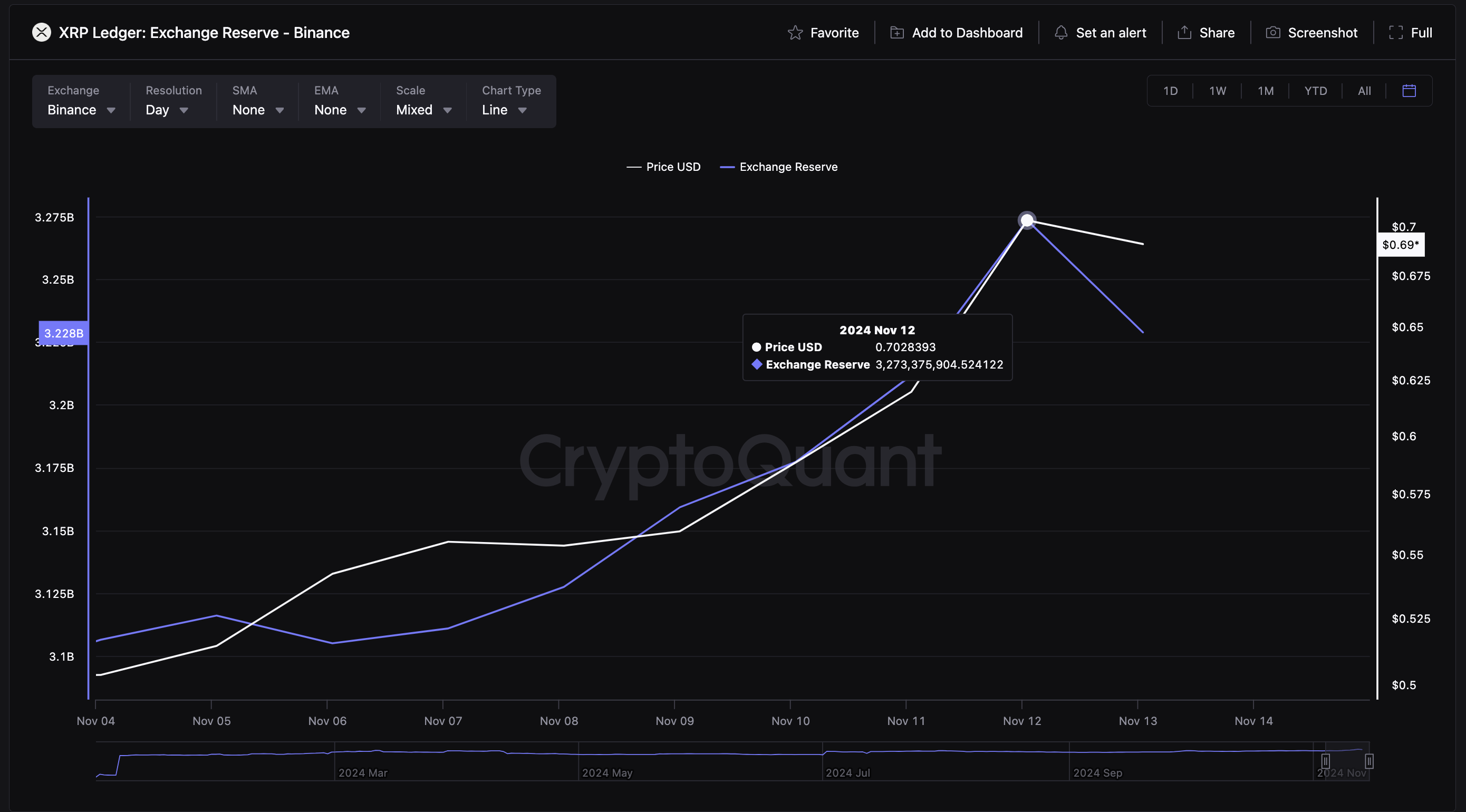

Confirming this narrative, CryptoQuant’s exchange reserves metric tracks the supply of XRP coins deposited on major trading platforms.

XRP Exchange reserves | XRPUSD

The chart above shows the Exchange reserves stood at 3.27 billion XRP at close of November 12.

But following the Robinhood listing, traders moved 45 million XRP out of the short-term market supply, cutting down the exchange reserves below 3.23 million XRP at the time of publication.

Valued at the current prices, XRP exchange outflows over the last 48 hours have crossed $33 million.

When exchange supply dips during a major rally, as observed in the XRP market this week, strategic investors interpret it as a bullish signal for two key reasons.

Reduced exchange reserves typically suggest a shift toward long-term holdings rather than seeking immediate exit opportunities.

This reduction in liquid supply can intensify upward price pressure as fewer tokens are available for rapid sales.

Hence, if demand persists, XRP’s ongoing rally could gain further momentum and advance toward the next psychological resistance level at $0.80.

XRP price forecast: $0.80 breakout still in play if $0.70 support holdsAfter peaking at $0.75, XRP price has retraced mildly to consolidate above the $0.73 level at press time on Thursday.

However, with the $33 million exchange outflows tightening the market supply, XRP price appears on the verge of another leg-up toward the $0.80 level.

The bullish thesis is supported by the rising green bars on the Bull-Bear Power (BBP) technical indicator, suggesting strong buying momentum.

XRP price forecast | XRPUSD

Should XRP maintain short-term support above the $0.70 level, bulls could regroup for a major attempt at reclaiming the $0.80 resistance level, with further potential to reach $0.85 if buying pressure sustains.

However, this bullish thesis could be invalidated if XRP drops below the $0.70 support, as it may trigger selling pressure. In that scenario, a decline to the R1 pivot level around $0.60 could ensue.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.