Crypto market liquidations hit nearly $500 million as Ripple and ...

Crypto markets witnessed a massive surge in bullish momentum on July 13 as the judge ruled partially in favor of Ripple in the long-standing United States Securities and Exchange Commission (SEC) vs. Ripple lawsuit. This caused Bitcoin (BTC), Ethereum (ETH) and many altcoins to rally violently.

While Ripple’s XRP more than doubled, its competitor Stellar (XLM) token, shot up 107% in under 24 hours. Other altcoins like Cardano (ADA) also saw massive gains. But as the weekend rears its head, the optimism seems to be dissipating.

More Ripple/XRP coverage

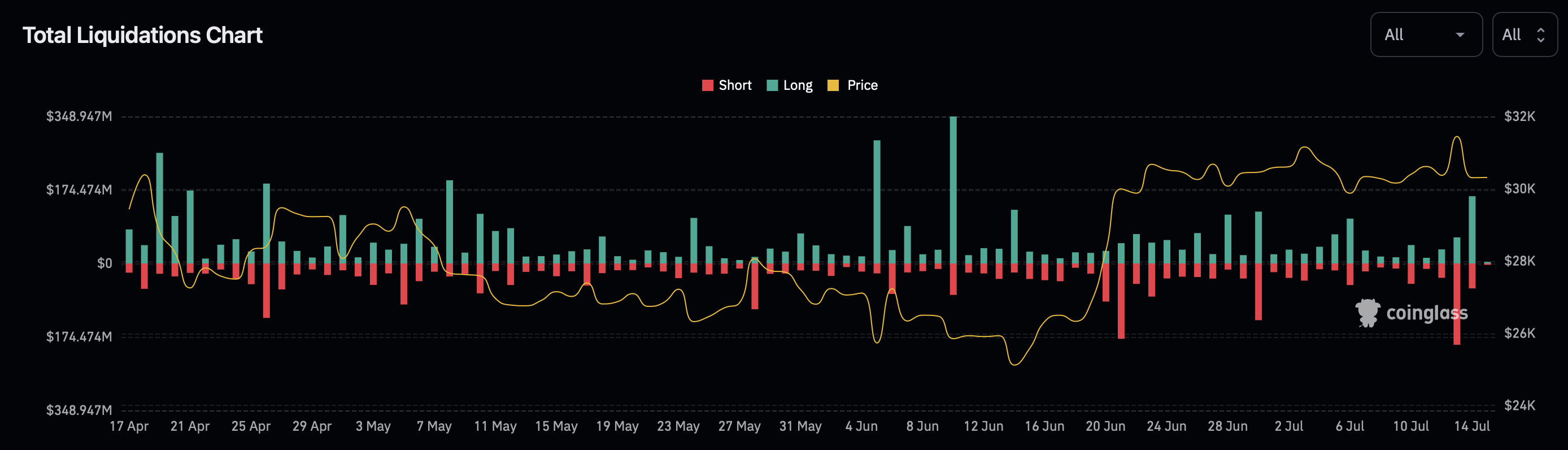

XRP update: Ripple win in landmark SEC case likely puts XRP and crypto market in jeopardy for these reasons Can XRP price hit $1? Watch these levels next Breaking: Ripple records landmark win against the SEC as court rules XRP is not a security except... Crypto markets bleed as bulls disappearFrom the announcement of Ripple’s partial win against the SEC on July 13 to date, $473 million worth of positions have been liquidated, according to data from CoinGlass. As seen in the chart below, there are massive short and long liquidations on July 13 and 14, respectively. The last time a liquidation event of this magnitude occurred was between June 5 to 10.

Total Liquidations chart

XRP price, which exploded from $0.469 to $0.938 on July 13, has since dropped 22% and currently trades at $0.726.

Ripple’s close competitor, XLM price went from $0.0953 to $0.197 and has since shed a whopping 32% and currently auctions at $0.133.

Why the sudden shift in market sentiment?The stark shift in the mood of investors could be attributed to three reasons:

An inherently bearish market outlook before the announcement of the SEC vs. Ripple lawsuit decision. More commentary on the lawsuit started surfacing after the initial announcement, which allows the SEC to contest the decision in the second circuit court of appeals. Moreover, the decision is partly a win for the commission as well since XRP sold to institutions constitutes security. Mean reversion; markets often revert to mean after the hype or frenzy dissipates, and the ongoing pullback could be just that.Due to the aforementioned reasons, the crypto markets seem to be returning to the mean, undoing recent gains. A sign of this can be seen as investors on exchanges have flipped their narrative to bearish.

Read more: Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Weekend price swings to kick in

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.