Live updates: Coles hoarding cash over Armaguard fears, while ...

Armaguard has rejected a $26m lifeline offered by some of Australia's biggest companies to keep cash moving around the country.

The company had until today to accept or reject the offer.

Meantime, the ASX continues to tracker north, following Wall Street's new record overnight.

Follow the day's financial news and insights from our specialist business reporters on our live blog.

Disclaimer: this blog is not intended as investment advice.

Price current around 11:30am AEDT.

Live updates on the major ASX indices:

Key Event

Armaguard rescue deal has collapsedArmarguard has rejected a $26 million lifeline offered by some of Australia's biggest companies to keep the cash transport company afloat.

Armaguard, which is controlled by trucking magnate Lindsay Fox, had been given until the end of today to either accept or reject a financial lifeline to avert insolvency, and to keep cash flowing to major businesses.

Major banks, supermarkets, Australia Post and retailer Wesfarmers proposed the $26 million rescue package last week.

Armaguard Group chief executive, Mick Cronin, has issued the below statement:

"Armaguard confirms it is working constructively with all its customers, including its retail customers, banks and other key stakeholders regarding both short term and long term financial solutions for the industry to remain sustainable.

"Armaguard continues to operate its full suite of services and is confident that over the coming months, it will get the business onto a long term sustainable footing with appropriate support from the industry."

Former ACTU secretary and Linfox director Bill Kelty represented Armaguard at a meeting chaired yesterday by Reserve Bank governor Michele Bullock underscoring the urgency of a resolution.

Key Event

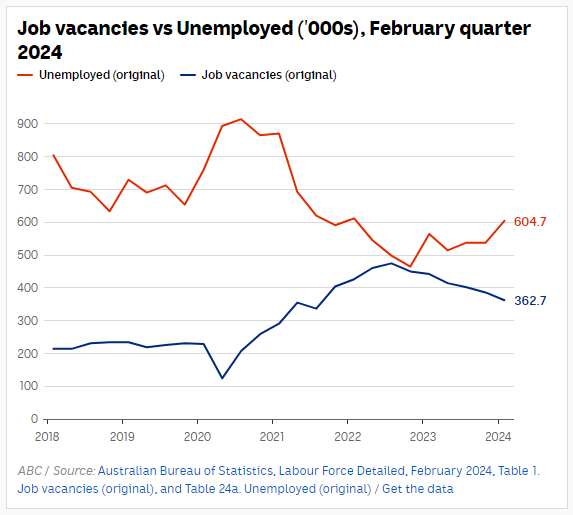

Job vacancies continue to declineThe Bureau of Statistics released a bit of data this morning which provides more detail for last week's unemployment numbers.

It helps us to update pictures like this one, which shows the relationship between unemployment and job vacancies.

(I used the "original" numbers to make this graph, rather than "seasonally adjusted" numbers).

If you recall, last week's numbers from the ABS showed that the unemployment rate had surprisingly dropped between January and February from 4.1% to 3.7%.

It raised some eyebrows among economists, because GDP data show that economic activity has well-and-truly slowed down over the last year, so why would the unemployment rate drop so much when economic activity has obviously been weakening?

The consensus seemed to be that we should wait a few months to see what happens to the data, in case there's something strange going on.

But in the meantime, economists said we should be prepared to see the sharp drop in the unemployment rate reverse quite quickly in coming months, since the number of job vacancies is continuing to decline.

And today's data provide evidence for that argument.

Between November and February, the number of job vacancies shrank by 23,800 (in original terms) while the number of officially unemployed people increased by 66,900.

Job vacancies are still much higher than they were pre-COVID, but they're now 23.5 per cent lower than they were at their peak in mid-2022 and they're heading lower - and we can expect to see unemployment heading in the opposite direction.

Key Event

Aussie gold miner backs away from takeover talks with Canadian outfitAustralian gold miner Ramelius Resources will not proceed with a potential acquisition of Canadian miner Karora Resources.

Ramelius confirmed earlier this month it was in exclusive discussions with Karora.

But it has today notified the market those discussions are over.

"Following its usual disciplined due diligence process, Ramelius advises that no final agreement, including on value, was reached," the company said.

Karora Resources, which is focussed on increasing gold production at its Beta Hunt gold mine and Higginsville gold operations in Western Australia, confirmed in a separate statement that it had ended discussions with Ramelius.

Karora said it was engaged in exclusive negotiations with a new third party regarding a potential merger.

Shares of Ramelius rose as much as 2.2% to hit their highest level in nearly three years.

Key Event

Conditions to cut New Zealand cash rate becoming more apparentThe head of the Reserve Bank of New Zealand, Governor Adrian Orr, has indication conditions are evolving that would allow the central bank to cut the official cash rate.

"Core inflation pressures are coming off and inflation expectations are coming back to target."

"We hope that we can see low and stable inflation on the horizon again and that would mean more normalized interest rates on the horizon again," Orr told state-owned Radio New Zealand on Thursday.

"We're in a much happier space where most central banks [around the world] are feeling like we're back on top of inflation. We're not there yet but economies are starting to respond as we would have expected in the absence of these shocks," he said.

The RBNZ held the cash rate at 5.5% when it met at the end of February, but trimmed the forecast peak for rates.

Data last week showed New Zealand's economy is now in a technical recession, with inflation in the fourth quarter at 4.7%.

The Governor said the economy was performing broadly as the central bank had anticipated, with demand off considerably and inflation pressure returning to levels that are containable, "which is wonderful news."

Key Event

Gold keeps glitteringGold investors are petty happy at the moment, with the price hovering around record highs of $US2,200 an ounce.

It's a huge jump from the roughly $US1,800 back in October.

Bellevue Gold has just opened Australia's newest gold mine, here in Western Australia.

They timed it pretty well — though in all honesty, starting a mine takes years, so that was just a fluke.

I went along to the opening and my story will be on The Business tonight — but for viewers keen to see lots of shiny metal and hi-vis, we've already posted it to the ABC News YouTube channel — so you can watch it right now.

Gold miners are among the top performing stocks today.

Red 5 + 5.48%Regis Resources +3.60%Newmont + 3.56%Bellevue Gold + 2.32%Key Event

The market's posting solid gainsWe're an hour or so into trade, so let's check where things stand.

All sectors are up:

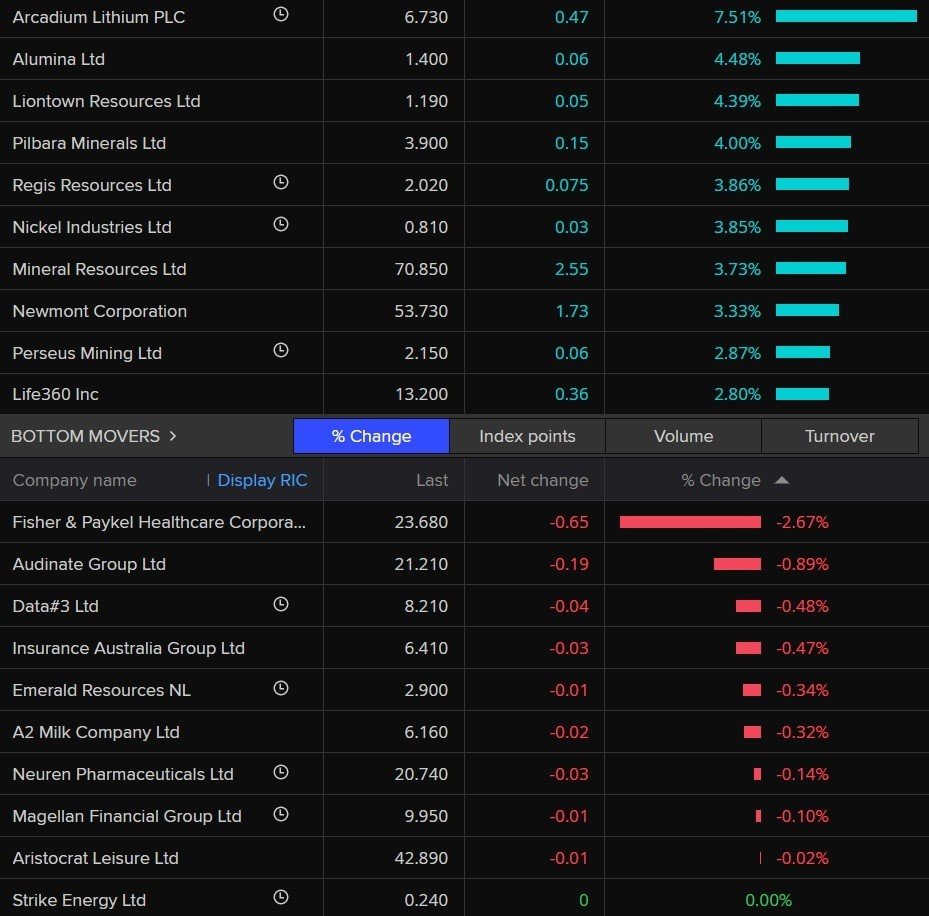

Real Estate +1.86%Basic Maerials +1.71%Energy + 0.79%Utilities + 0.77%Consumer Non-Cyclicals +0.76%So here are the top five stocks this morning:

Arcadium Lithium +8.07%Alumina +5.78%Whitehaven Coal +4.60%Liontown Resources +4.39%Red 5 +4.11%It's not rosy for everynone though, here are the bottom five stocks:

PEXA Group -1.85%Audinate group -1.92%Siteminder -1.44%Fisher & Paykel -1.36%Data#3 -1.21%Overall, the ASX 200 is up 0.73%, or 56.3 points to 7,875.9 points.

The All Ordinaries is up 0.68% or 55 points to 8,129.2 points.

Hello!

It's time for me to take over from Emilia to carry us through the rest of the trading day.

Look out for special appearances from Gareth Hutchens too, we're expecting some more labour force data in the next 20 minutes or so from the ABS, so Gareth will bring us all that detail.

I'll start polishing up my charts and tables to bring you through the afternoon.

As always, I love to hear from you — please reach out using the comments box.

I'm keen to know, with the news around cash transport logistics with Armaguard — are you tempted to withdraw some cash today just in case?

This latest piece by ABC compares the buying power of a 30-year-old in Australia today to one of years past.

Warning: depressing content.

All 11 sectors are higher today!

Materials is the best performing sector, gaining +1.60% and +0.86% for the past five days.

It's up 3.3% today.

Which doesn't help you a whole lot when you're sitting at 16 cents. The company crashed after lithium's prices did the same, and it had to stop production at its facility near Darwin.

(Eikon)Key Event

ASX 200 is tracking even closer towards 8000Wiĺl we see an 8 in front the 7 in the ASX soon???

- Rob

Who truly knows what will happen next though.

Here are the top movers and losers.

(Eikon/Reuters)The ASX 200 is currently up 0.7% on open to 7877 points.

It even hit 7,880.60 on open, which is a record trading high.

More to come.

The TWU is calling for help for its unionised members at the cash transport company, and even wants the banks to chip in to keep Armaguard afloat.

So how many workers does it have there?

The union says it's got 700 members there, who do things like drive the armoured trucks, which is a dangerous job.

There would be more workers than this 700, perhaps up to 1400 people.

Key Event

TWU in talks with Armaguard about its frontline workersWhile the RBA and banks try to work with Armaguard to solve the latest crisis at the company, the union says it's also in "ongoing discussions" with the cash transport company owned by Lindsay Fox.

The Transport Workers Union represents lots of the company's workers, including its armoured truck drivers.

“Cash-in-transit workers do an important job, but it is a dangerous job," TWU national secretary Michael Kaine just said in a statement sent to media.

"Armed hold-ups and deaths in the line of duty are known in this industry.

"It’s critical for the safety and wellbeing of these transport workers that this is resolved quickly with a view to the future. With the public holiday approaching, workers need certainty and peace of mind."

He claims the banks, which use Armaguard's services to deliver money between branches, have been "squeezing" the cash transport industry "for years".

TWU is calling on the banks to pay to keep Armaguard afloat.

"This is not about a lifeline to a struggling transport operator, it’s about client responsibility, and banks paying what it takes to keep cash in service — something Australia needs," Mr Kaine said.

More from the ABC's Peter Ryan.

More dividend payments will be made to investors next week, CBA analysts have noted this morning.

"In fact, around $3.9 billion is paid," they say.

"Given that most shareholders receive the payments as cash (deposits into bank accounts) the data has importance for spending and debt repayments.

"The key day is Thursday when $1,847.2 million will be paid out by ASX 200 companies.

"On limited data available, around 10 per cent of shareholders use dividend reinvestment schemes."

Tech giant Meta is facing allegations that it has misled Australians by exaggerating its response to disinformation and misinformation on Facebook.

The ABC can reveal the $US1.3 trillion ($AU1.9 trillion) company is the subject of a formal complaint, which alleges Meta is not living up to claims contained within its most recent transparency report.

The seven-page submission by online safety research group Reset.Tech, states small changes such as rewording can circumvent Facebook's automated labelling of known falsehoods.

Read more here.

#ICYMI on last night's episode of The Business!